By: Ed Cox, Editor Global LNG, ICIS

Ruth Liao, Editor Americas, ICIS

Ed Lane, Editor Singapore, ICIS

Demand for the LNG glut this summer is a hot topic, with key importers at varying stages of buying need and ability. Some will buy more spot cargoes, others are constrained by price and capacity.

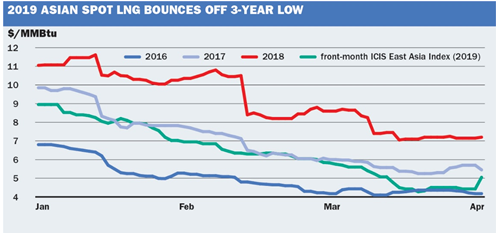

Spot LNG prices have bounced up from three-year lows in recent sessions, supported by bullish days on European gas markets and signs of summer demand from Asian buyers.

The market has been oversupplied for the past few months, despite China’s demand continuing to rise and a jump in deliveries to Europe. So what is the outlook for LNG demand for the coming summer and in the fourth quarter?

With US LNG exports to ramp up over the second half of 2019, ICIS takes a global view across the key importing markets.

Softer summer in China?

April marks the beginning of a lower demand season for domestic Chinese gas.

Although the prompt spot LNG market into China is lucrative on paper compared to domestic prices, high LNG terminal stocks and a lack of storage capacity has curtailed spot demand.

LNG demand from industrial and chemical sectors has been dented by a raft of monthlong plant safety inspections triggered by a recent major accident at a chemical plant.

A mild winter, which capped LNG consumption for winter heating, has also contributed to high LNG terminal stocks. Chinese importers are trying to reduce these by cutting prices of truck-delivered LNG.

Spot LNG prices are lower than even the lowest city-gate price. Prices at coastal cities are much higher, with Shanghai at around

$8.7/MMBtu. But most domestic city gas companies are unable to profit from the arbitrage, as they lack access to local terminals.

Chinese independent buyers Shenergy Group and Guanghui Energy do have the ability to buy incremental spot cargoes.

But China remains the LNG growth market globally, and monthly increases in LNG imports relative to one year ago are likely to continue. The market will closely monitor interest from the major Chinese buyers.

Nuclear impact on South Korea

South Korea’s steady drop in LNG imports in the first quarter of 2019 could continue into the summer even as concerns grow about air pollution from coal-fired plants and the government cuts taxes on LNG imports.

South Korea’s nuclear generation operated at close to 90% of total capacity in early April, following the restart of two reactors at the Hanul nuclear power plant last month. South Korean nuclear availability is now higher than at any point in 2018, reducing demand for LNG in the power mix.

Further nuclear additions are expected over the second half of 2019. Some dynamics of the South Korean energy market suggest a summer demand upswing for spot prompt cargoes after a tax cut in LNG imports came into effect on 1 April as duties on imported coal were hiked. But sources are doubtful this in itself will drive a switch towards gas.

South Korea has shut four older coal plants with a capacity of 2.1 GW from March to June to reduce air pollution.

The country relies heavily on coal for power generation and because of the sunk costs in existing plants, the country faces hard choices on pushing the wider use of LNG, even as the world’s third-largest importer.

Last winter, rules came in to reduce the level of particulate matter to cut pollution on particularly bad days. This could see oil and coal power plant generation reduced with gas stepping in. But the measure was only implemented on six days in the recent winter.

The huge capacity of incumbent KOGAS’ terminals still means opportunistic spot LNG buying can appear at short notice.

Japan manages oversupply

Shipments to Japan were down by over 2m tonnes in the first three months of 2019 on mild winter demand and higher nuclear power generation, with local end-users facing high stocks at domestic terminals.

Although Japanese buyers may buy incremental cargoes ahead of the summer, spot demand

is expected to be capped as some utilities expect their inventories could stay high. Japanese nuclear availability is expected to be up by about 36% year on year, according to calculations by ICIS, up from around 49TWh in 2018 to almost 67TWh in 2019.

But nuclear generation is expected to flatten out in the third quarter of 2019 to similar levels as the previous year as maintenance kicks in.

In the event of a sustained heatwave, as happened in last summer, LNG demand could rise back, with utilities leveraging gas generation at short notice to cover demand for cooling.

2019 will see Japanese buyers become more prominent in the US LNG market. Chubu Electric and Osaka Gas are the two largest marketers from Train 1 at Freeport LNG, with Mitsui and Mitsubishi each taking a third of supply from the Cameron LNG project.

Slow progress on Indian terminals

India will remain an important source of spot demand for the rest of the year, with buyers keen to absorb gas when the price is competitive relative to oil products.

But the domestic gas market has slowed and the outlook for additional demand from new import terminals is limited.

Indian imports fell in the first three months of this year and local sources said the upcoming federal election, which will be held from April to May, had curbed downstream gas consumption from the industrial sectors.

This resulted in high stocks at the Dahej and Hazira import terminals, which account for around 90% of India’s imports.

Developer H-Energy has tendered for cargoes into the new Jaigarh terminal from October 2019 but supply can be delivered to other Indian terminals in case of issues at Jaigarh.

Commissioning of the Mundra terminal also remains uncertain, with project partners GSPC and Adani still working out a concession agreement before the project can proceed to commissioning.

The Ennore LNG terminal on India’s east coast was commissioned in March, but is not expected to take more than two to three cargoes this year because of limited pipeline connectivity, said a source from operator Indian Oil. Indian February gas consumption – the latest official data available – dropped to a two-year low, according to data from India’s Petroleum Planning and Analysis Cell, down by 2.1 % year on year.

Middle East not yet tempted

Middle Eastern LNG buyers have not yet been tempted by lower prices, preferring to meet demand with pipeline supply where possible.

Kuwait was the biggest regional LNG importer in both 2018 and the year to date.

State buyer KPC had approached the market in March with a tender for April delivery but later withdrew it, and traders this week said it had not signalled buying interest since.

The second-biggest buyer in 2018 was Egypt, but rising domestic production means the country has been selling cargoes via tender rather than buying them.

Domestic fertiliser producers in Egypt have reported much improved feed gas to their plants this year.

Jordan is well supplied from Egyptian pipeline imports and a long-term LNG contract with Shell.

The government restarted imports from Egypt in September last year and in January signed a deal to increase flows to meet around half the country’s daily gas demand of 9.3mcm/day, with the other half coming from the existing 1 mtpa LNG supply deal with Shell and modest domestic production. LNG imports have fallen so far in 2019.

A source at the energy ministry doubted demand was high enough to justify spot cargoes, saying on Tuesday 9 April that Egyptian flows often exceeded their target, rising to as high as 6.2mcm/day in recent days.

Regional gas consumption tends to peak in the third quarter, so there is still time for spot demand to emerge. But with prices flattening out over the past week, the cheapest cargoes may have already gone.

Europe back in the LNG mix

Tight spreads between global LNG markets suggest Europe will remain a preferred option for flexible and spot cargoes over the summer.

Recent European gas prices have been volatile, driven up and down by coal and carbon. This in turn has influenced sentiment globally on LNG with a correlation between gas and LNG likely to continue over the summer.

Northwest Europe can absorb LNG but domestic storage sites are well stocked and this could limit demand to move gas into storage over the summer.

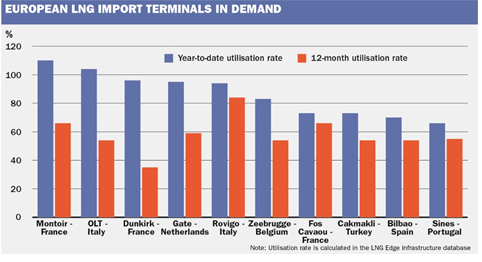

Terminal utilisation rates, especially in the northwest, have been very high so far this year, with limited scope for further increases in some cases.

Utilisation levels in Spain remain among the lowest in Europe.

Strong production from Yamal and a rise in Qatari deliveries to northwest Europe offer stern competition for other suppliers.

Switch to gas generation

Germany’s gas-fired power generation is forecast to exceed hard coal power output in 2019, according to the Power Horizon Model. 571Wh of electricity is expected to be produced from gas-fired power plants, while 551Wh of electricity will be generated by hard coal.

This is a first for the German power mix, and is tied to the recent lower gas prices which have filtered through to the forward curve, in part caused by the level of incoming LNG to European terminals.

Long term, any influence that LNG has on reducing European gas prices could support gas in domestic power mixes. But for this year, in northwest Europe at least, the scope for gas demand to rise substantially is limited.

In southern Europe, early forecasts of a hot summer could support gas demand for power generation in Italy, which may in turn maintain interest in spot supply into the OLT Toscana terminal on the west coast.

Spain has missed out on the surge of incoming LNG seen into other European terminals. Some contract volume with Algeria is now supplied on a flexible basis and has so far this year been absent from the Spanish mix. Possibly this could return, although buyers including Endesa and Iberdrola will soon start to lift from US contractual positions which will offer flexibility.

A hot, dry summer could hit hydroelectric generation and bring Spanish gas back into the mix, supporting LNG demand. But Algerian pipe gas flows may also increase.

In the UK, spot opportunities will persist for LNG sellers but the lack of the major Rough storage site will limit injection demand over the summer.

UK gas demand for power generation was steady in the first quarter, averaging 61 mcm/day, up from 60mcm/day in 2018.

Data from the ICIS power horizon model forecasts that gas for power generation capacity is set to be 34GW in 2019, the same as 2018. Longer term, the case for cheap gas and LNG to boost a share in the UK generation mix is strong.

High Turkish demand, but obstacles

Demand for Turkish LNG could break record levels in 2019, as the

country is taking advantage of falling global prices and its expanded import

capacity while renegotiating its supply contracts with Russia via the upcoming

TurkStream corridor. However, Turkey’s ability to break the record may be held

in check by internal market constraints, in the form of government regulated

tariffs.

In addition, even if the US dollar-denominated price of LNG were to fall further this year, there is a risk that the depreciation of the Turkish lira would make it unaffordable for the Turkish private sector. The currency fell 40% against the US dollar last year and has fallen another 4% this year largely because of internal political turmoil.

On top of that, private companies licensed to import spot LNG also have long-term supply contracts with take-or-pay obligations and destination clauses. Unless Turkey succeeds in negotiating the scrapping of these terms in its Russian contracts, Turkish companies would be locked out of the global LNG market.

In Greece, summer LNG demand has typically been limited to one or two cargoes per month. Greece was a much more obvious spot buyer over the latest winter but this level of interest will not continue into the summer.

The Revithoussa LNG import terminal is shut for maintenance from 9 April to 9 May.

Argentina enters peak demand

Argentina’s state-run gas distributor IEASA is entering its peak winter demand season, with the bulk of its imports expected between May and September.

In 2018, IEASA imported 2.53m tonnes between April and September, purchasing a total of 56 cargoes on the spot market. At least two of the cargoes purchased in 2018 were rescheduled for 2019 delivery.

So far, IEASA has purchased 23 cargoes for 2019 delivery.

Demand in 2019 is expected to be similar to the previous year, sources said, expecting that IEASA would tender for the same number of cargoes, except that the volumes would only be delivered to Argentina’s Escobar terminal.

The remaining cargo windows are expected to be sought for August and September delivery, and potentially in May, depending on winter temperatures, sources said. As such, IEASA would benefit from lower market prices given its dependence on the spot market.

The Shell chartered 138,000cbm Gemmata arrived at the Escobar terminal on 29 March, bringing a partial cargo into the floating import terminal, but the vessel was meant to be delivering volumes to commission the newly-installed small-scale liquefaction barge at Bahia Blanca.

The Tango floating LNG export project is under charter by Argentina’s state-run producer YPF. Market sources, however, do not expect Tango FLNG would be ready to produce any LNG until after the end of the southern hemisphere winter, which would be by September or October.

Brazil motivated to optimise

State-run Petrobras could have an appetite to import more spot cargoes, given that prices have become low enough to incentivise optimisation.

Given that Petrobras has its own chartered shipping length and the ability to purchase cargoes on a free-on-board (FOB) basis, the buyer has the ability to wait for prices to become attractive enough and may buy even if the country’s generation matrix is well supplied, one source said.

In the first quarter of 2019, low rainfall and hot temperatures caused a strain on Brazil’s power price, as hydropower generation fell. In the first quarter of 2019, Brazil’s LNG imports were four times higher than in 2018.

Volatility in Brazil’s demand is a hallmark of the country’s heavily reliance on hydropower generation.

Increased domestic gas production has enabled Petrobras to become more selfsufficient, although extended production maintenance periods have spurred occasional spot LNG purchases.

Mexico to take pipeline gas

Increased gas pipeline capacity from the US means that LNG demand from Mexico’s state run utility CFE will eventually be displaced by US imports. But pipeline infrastructure delays continue, particularly around the long-haul transportation projects that have encountered right-of-way issues and technical glitches.

This means that LNG could still be relied upon in the short to mid-term given that the terminals still provide supply access to imbalances in Mexico’s grid. For the first three months of 2019, Mexico imported 832,000 tonnes of LNG, 20% lower than the first quarter of 2018.

CFE has purchased at least 16 spot cargoes for 2019 delivery, seven for its Altamira terminal on the Gulf Coast and nine for its Manzanilla terminal on the Pacific coast. CFE could tender for deliveries for May and beyond.

LNG imports could be a solution if there are further delays on the construction of the 2.6 billion cubic feet (bcf)/day Sur de TexasTuxpan submarine pipeline, which is to connect south Texas to Veracruz, Mexico.

Sources said the pipeline could start up around June, but testing and other connection work would likely mean several months before a full ramp up.

Community consultations also have been ongoing around the Villa de Reyes and Tuxpan-Tula pipelines developing downstream of the submarine Tuxpan pipeline.

The Villa de Reyes pipeline could come online in late 2019, while Tuxpan-Tula is not expected to be online until 2020, although timelines have both slipped for these projects.

LNG imports into Altamira quadrupled in 2018 compared with 2017, as CFE relied more heavily on the spot market to make up for imbalances on the Sistrangas pipeline system. But in the first quarter of 2019, just 255,000 tonnes was delivered to Altamira, according to LNG Edge, about 45% less than the year before.

ILNG into Manzanilla could still be sought on an occasional basis, considering that CFE has two CCGT power plants at Manzanilla that are currently not supplied by the grid.

The La Laguna-Aguascalientes gas pipeline was due to start up in November 2018, which would bring down supply from the Waha gas hub in western Texas through central and western Mexico. Delays pushed the pipeline start date back to May.

The connecting Villa de Reyes-Aguascalientes-Guadalajara pipeline, which also would connect to the industrial areas in southwestern Mexico, has also been delayed to May 2019.

Chile incentivised by low prices

Low spot prices in the global market have incentivised some demand from buyers such as Chilean consortium GNL Chile. On 3 April, GNL Chile issued a spot tender for two cargoes for delivery in the second half of September and the first half of November for its Quintero terminal.

Chile typically is well supplied with longterm contract volume between portfolio seller Shell and members of the GNL Chile consortium. But the low LNG prices have been attractive enough for the consortium to consider buying on the spot market compared to alternative fuels such as oil-fired generation, coal and hydropower generation.

Natural gas makes up about 19% of installed generation capacity, according to Chile’s National Energy Commission 2018 figures.

Partial cargoes for the Caribbean

Any appetite this year from Caribbean importers is likely to come as smaller deliveries to meet incremental demand, particularly as partial cargoes. Puerto Rico’s EcoElectrica, which typically is supplied by long-term cargoes by Spanish energy company Naturgy and France based ENGIE, could be looking for a spot cargo in October, sources said.

Colombia’s consortium Calamari, which purchases for the Cartagena FSRU, is not likely to need any spot LNG given that the company awarded partial deliveries to Naturgy in late 2018. The terminal was installed to bring in LNG during an El Nino year when the country experiences drought conditions and hydropower generation could be curbed.

In Jamaica, utility Jamaica Public Services is supplied through a long-term contract with US developer New Fortress Energy, which, in turn, secured cargoes on a mid-term basis from UK-based Centrica. Sources said New Fortress Energy could be looking for new supply in 2019. A partial cargo in February delivered into Jamaica was supplied by trading company DXT to New Fortress Energy. However, it was unclear whether New Fortress Energy had purchased any other supply.

Are there any other short-term LNG opportunities?

The disappearance of Egypt from the shortterm and spot market has left a demand gap with no equivalent buyer ready to step in. At its peak, Egypt imported almost 7m tonnes of LNG in 2016, but rising domestic gas production means it has already swung back to being an exporter.

Among new and developing buyers, Bangladesh will provide some opportunity for sellers this year as its second floating import terminal starts up in April. The majority of cargoes will be delivered under term deals with Qatar and Oman but spot demand may emerge.

Pakistan has tendered for additional cargoes on several occasions but is in discussions with Qatar over a potential increase in term supply. Bahrain will join the importers’ club in May but will have limited requirements.