Tinka Provides Exploration Update on Huwaymidan Gold Project in Saudi Arabia Including Completion of 3,400-Metre RC Drill Program

Vancouver, British Columbia–(Newsfile Corp. – January 12, 2026) – Tinka Resources Limited (TSXV: TK) (OTCQB: TKRFF) (“Tinka” or the “Company“) is pleased to provide an update of the exploration activities at the Huwaymidan gold property in Saudi Arabia. The Huwaymidan property (“Huwaymidan” or the “Project“) is owned by Midad Al Mona Mining Company (“Midad“), a Saudi Arabian company of which Tinka has a minority (5%) equity ownership. Tinka has a free-carried interest until mid 2027 and is responsible for providing technical expertise and exploration leadership to the Project. Exploration on the ground is largely carried out by third-party consultants and local contractors.

Key highlights:

-

Reconnaissance 3,400 metre drill program completed at Huwaymidan – A 46-hole reverse circulation (RC) drill program was carried out in December 2025. The drill rigs have now demobilized, with assay results pending.

-

District-scale orogenic gold potential – The initial drill program targeted gold mineralization identified by selective surface sampling at two target areas covering a potential gold trend of more than 5 kilometres.

-

High-grade gold in surface samples – Selective surface rocks graded up to 30.5 g/t gold in quartz float and up to 6.4 g/t gold in outcropping quartz veins. Refer to technical discussion for more details of rock sample results.

-

Significant zones of quartz veining and widespread hydrothermal alteration – Drilling intersected wide zones of pervasive hydrothermal alteration and quartz veining, features consistent with a large orogenic gold system. Note that no gold assays are available at this time.

-

Next steps – Assay results from the drilling are expected late Q1 2026. Subject to results, a follow-up drill program is planned for Q2 2026.

Cautionary note: by their nature, surface samples represent selective samples and do not necessarily reflect the overall grade of underlying mineralization.

Dr. Graham Carman, President and CEO of Tinka, stated: “The exploration program at Huwaymidan is advancing very well, with encouraging surface results for gold and the completion of an initial 3,400 metre RC drill program within 6 months of acquiring an interest in the property, thanks to the support of our local partner and our consultants. Huwaymidan is located in a proven gold belt just 30 kilometres along trend of Maaden’s Ar Rjum project (3.9 Moz gold) and we believe Huwaymidan has the potential to be a district-scale gold target. The aim of the reconnaissance drill program was to drill test the most obvious surface gold occurrences on a wide-spaced drilling grid. We look forward to receiving gold assays soon, so that the most promising areas for gold can be quickly followed up with additional work including more focused drilling.”

“The exploration programs at Huwaymidan are fully-funded by our local Saudi partner until mid 2027. The main focus of Tinka’s exploration remains our 100% owned Ayawilca zinc-silver project, and our early exploration stage Silvia gold-copper project in Peru.”

Technical Discussion

Exploration completed in 2025

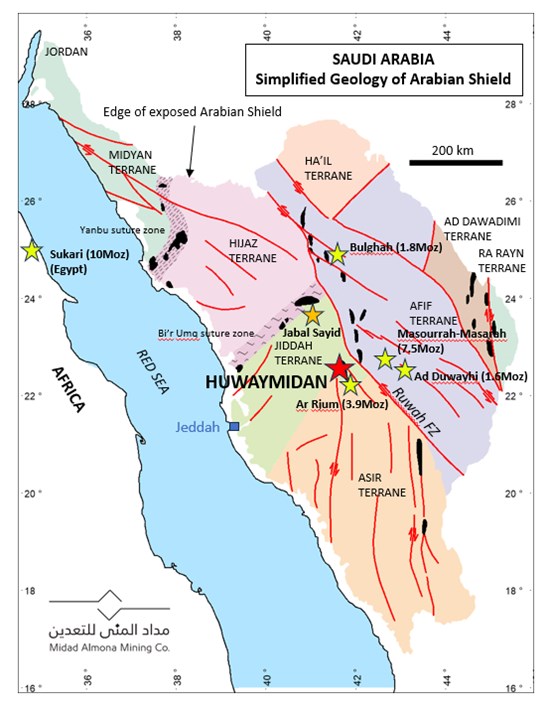

Tinka acquired a minority stake in the Huwaymidan gold property in Saudi Arabia during July 2025 (see release dated August 19, 2025). The Project is located 300 km east of Jeddah and is close to excellent infrastructure including a major highway and large town. The geology consists mostly of mafic volcanics and intrusions of Proterozoic age (~900–550 million years) of the central Arabian Shield (Figure 1). Several large orogenic-style gold deposits are known within the central Arabian Shield, including Maaden’s Ar Rjum gold deposit (~3.9 Moz Au in resources) 30 km along trend to the southeast of Huwaymidan, and the Mansourrah-Masarah gold mine (~7.5 Moz Au in resources) some 100 km to the east.

Exploration at the Huwaymidan Project (34 km2) has progressed significantly during the second half of 2025. Systematic geological mapping and sampling was conducted in September and October with more than 500 rock samples assayed for gold and pathfinder elements. A 340 line-kilometre ground magnetic survey was acquired over the entire property in October 2025. The results of this exploration have identified a 10-kilometre gold trend exposed discontinuously throughout the Huwaymidan property, believed to be associated with a large district-scale orogenic-type gold system.

A reconnaissance RC drilling program commenced in late November 2025 and was completed by the end of December 2025. The drill program was designed to follow-up on encouraging gold assays from surface sampling. In total, 46 holes for 3,436 metres were drilled with two rigs operating. All holes were drilled at an angle of between 50 and 60 degrees on a grid pattern, to an average downhole depth of 75 metres. Two areas were drill tested on ~250 metre-spaced drill lines covering a combined trend of approximately 5 kilometres.

District-scale orogenic gold target

Gold mineralization along the Huwaymidan gold trend is associated with quartz veining and hydrothermal alteration of andesite volcanic host rocks. Much of the Huwaymidan trend is covered by wind-blown sand on the flat-lying desert terrain. Surface sampling of discontinuous outcrops of quartz veins as well as quartz float samples has defined two gold targets at the Ibriz and Rawasi areas. Both areas were the focus of the initial 3,400-metre RC drilling program:

- Ibriz: 2 km by 0.4 km area with abundant quartz ‘float’ grading up to 30.5 g/t gold (refer to Table 1).

- Rawasi: 3 km by 0.4 km area with outcropping quartz veins with associated silica-hematite-pyrite alteration grading up to 6.4 g/t gold.

Table 1. Summary of selective quartz vein samples collected at Huwaymidan in 2025 exploration activities

| Target | Sample type | Number of samples | Area covered by sampling | Average sample width | Mean Au g/t | % of samples grading > 0.10 g/t Au | Range of gold values |

| Ibriz | Float* | 67 | 2 km x 0.4 km | See note below | 0.93 g/t Au * | 28% | <0.01 to 30.5 g/t Au |

| Rawasi | Outcrop rock chip | 98 | 3 km x 0.4 km | 3 m | 0.35 g/t Au | 55% | <0.01 to 6.4 g/t Au |

* Float samples are rock samples collected at surface not in their original bedrock position. Each float sample consisted of quartz vein material collected over a radius of ~25 metres. Quartz float samples were collected on the edges of old trenches now filled with sand – while these samples are displaced from their original position, they are thought to be within a few tens of metres from their source.

Cautionary note: by their nature, surface samples represent selective samples and do not necessarily reflect the overall grade of underlying mineralization.

Background of Huwaymidan Project ownership

The Huwaymidan Project covers a licence area of 34 km2 in the Mekkah region of central Saudi Arabia, approximately 300 km east of Jeddah. The Project was acquired by a mining consortium which included Tinka as principal technical partner in Round 6 exploration licence auction held by the Ministry of Industry and Mineral Resources of Saudi Arabia (the “Ministry”) in November 2024. The Ministry transferred the Huwaymidan concession to Midad Al Mona, a private Saudi company, in July 2025. Tinka owns a 5% carried interest in Midad Al Mona while our Saudi partner owns 94%. The exploration and administration costs are fully covered by our Saudi partner for the first two years (up to ~C$3.3 M). Our Saudi partner is a well respected and financed family-owned group with limited experience in mining and exploration. Tinka is responsible for providing technical expertise and exploration leadership, and in overseeing the field programs to be largely undertaken by 3rd party consultants and local personnel. Consulting fees are paid to Tinka technical personnel, at market rates, capped at US$250K over two years. Following the initial two-year period, Tinka may continue to hold its interest via a renewed consulting agreement or by a funding arrangement.

Figure 1. Simplified Geology Map of the Saudi Arabian Shield and location of the Huwaymidan project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2197/280023_fd0d879f44fb0813_007full.jpg

Data sources: Mineral Resource tables in Annual Reports for Maaden and Centamin (now AngloGold Ashanti) at Dec. 31, 2023.

Note on assaying

Rock chip samples from Huwaymidan were sent to SGS Ankara for analysis for gold fire assay (30 g aliquot) and ICP multielement analysis.

| On behalf of the Board, “Graham Carman“ Dr. Graham Carman, President & CEO |

Further Information: www.tinkaresources.com Tim McNulty 1.604.290.8100 info@tinkaresources.com Stay up to date by subscribing for news alerts at Contact Tinka and by following Tinka on X, LinkedIn and Facebook. |

About Tinka Resources Limited

Tinka is an exploration and development company focused on base and precious metals projects in Peru. The Company’s flagship property is the Ayawilca zinc-silver-tin project which has substantial mineral resources of zinc (with silver-lead credits) and tin in separate zones. The nearby Silvia gold-copper project is the current focus of exploration drilling. The Company filed a NI 43-101 technical report on an updated PEA for the Ayawilca Project on April 15, 2024 (link to NI 43-101 report here). Dr. Graham Carman, Tinka’s President and CEO, has reviewed, verified and approved the technical contents of this release. Dr. Carman is a Fellow of the Australasian Institute of Mining and Metallurgy, and is a Qualified Person as defined by National Instrument 43-101.

Forward-Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively “forward-looking statements”). All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka’s management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure; unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; timing of geological reports; the preliminary nature of the Ayawilca Project PEA and the Company’s ability to realize the results of the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280023