Galiano Gold Delivers Annual Mineral Reserve and Mineral Resource Update, Highlighted by Maiden Underground Mineral Resources at Nkran and Abore

Vancouver, British Columbia–(Newsfile Corp. – February 12, 2026) – Galiano Gold Inc. (TSX: GAU) (NYSE American: GAU) (“Galiano” or the “Company”) is pleased to provide updated Mineral Reserve and Mineral Resource (“MRMR”) estimates for the Asanko Gold Mine (“AGM”), effective December 31, 2025, including maiden underground Mineral Resources at the Nkran and Abore deposits. Galiano owns a 90% interest in the AGM, located on the Asankrangwa Gold Belt in the Republic of Ghana, West Africa. All dollar amounts contained in this news release are in United States dollars.

MINERAL RESERVE HIGHLIGHTS

Mineral Reserve Estimate

- Proven and Probable Mineral Reserves of 47.5 million tonnes (“Mt”) at 1.29 grams per tonne (“g/t”) for 1.97 million ounces (“Moz”) gold contained.

- Mineral Reserves were reported based on gold prices of $1,900 per ounce (“/oz”) for Esaase, $1,700/oz for Nkran, Abore, Adubiaso, and Midras South, and $1,500/oz for Miradani North and Dynamite Hill.

MINERAL RESOURCE HIGHLIGHTS

Open Pit Mineral Resources

- Measured and Indicated Mineral Resources for open pit mines of 77.0 Mt at 1.27 g/t for 3.14 Moz gold contained, inclusive of Mineral Reserves.

- Inferred Mineral Resources are estimated at 20.7 Mt at 1.14 g/t for 0.76 Moz gold contained.

- Open pit Mineral Resources were reported based on gold prices of $2,400/oz for Esaase, Adubiaso and Midras South, and $1,800/oz for Miradani North, Akwasiso, Asuadai and Dynamite Hill. Open pit Mineral Resources for Nkran and Abore are reported within the current Mineral Reserve pit designs.

- Nkran and Abore Mineral Resources are constrained to the Mineral Reserve pit design due to the reasonable prospect for eventual economic extraction of mineralized materials below the pit design, using underground mining methodology.

Underground Mineral Resources

- Maiden underground Mineral Resource estimates for the Abore and Nkran deposits totaling 3.4 Mt of Indicated Mineral Resources at an average grade of 2.74 g/t, containing an estimated 0.30 Moz gold, and 6.5 Mt of Inferred Mineral Resources at an average grade of 2.52 g/t, containing an estimated 0.53 Moz gold.

- Underground Mineral Resource estimates are based on a gold price of $2,400/oz and a mineable stope cut-off grade of 1.5 g/t gold.

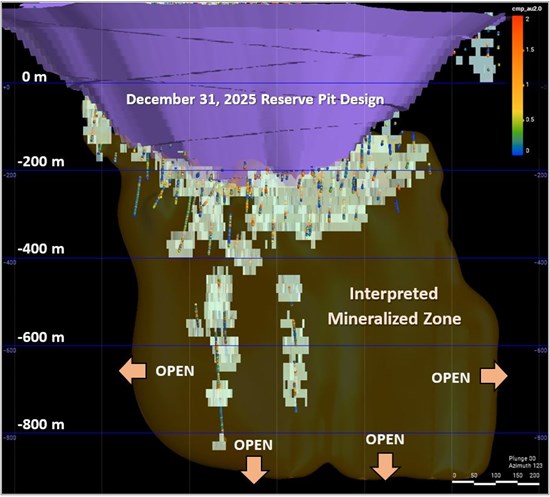

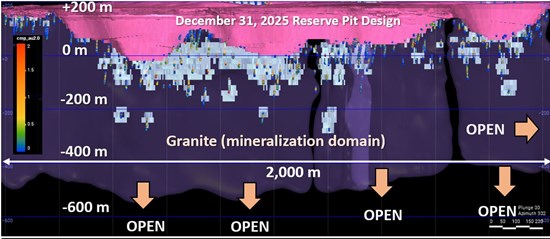

- Underground Mineral Resources are limited by the extent of current exploration drilling and are believed to represent a small portion of a much larger mineralizing system at Nkran and Abore, which remain open along strike and at depth beyond the current extent of Mineral Resources.

- The Company plans to advance near-term evaluation work to further assess the economic viability of integrating underground mining with the AGM’s existing open-pit operations, with the goal of declaring an underground Mineral Reserve and incorporating underground mining into the long-term mine plan.

“The maiden underground Mineral Resources at Nkran and Abore represent a new and meaningful growth avenue for Galiano, marking a clear inflection point for the Company,” said Matt Badylak, Galiano’s President and Chief Executive Officer. “With significant potential to expand resources at depth and along strike, we see a compelling opportunity to extend mine life, further convert resources into reserves, and unlock long-term value. As we execute our exploration strategy, we believe the AGM is well positioned to deliver sustainable growth and enhanced shareholder returns.”

MAIDEN UNDERGROUND MINERAL RESOURCE

Significant technical work was undertaken to develop the underground Mineral Resource estimates at Nkran and Abore, which was supported by exploration drilling results received through the end 2025. Geotechnical work undertaken by the Company’s Technical Team, and an independent consultant, suggests that the size, geometry and grades of the Nkran and Abore deposits are amenable to bulk underground mining extraction. Rigorous application of industry best practices in resource modeling and a technical assessment of mining methods demonstrate the positive economic prospect of underground mining at Nkran and Abore at a $2,400/oz gold price and a mineable stope cut-off grade of 1.5 g/t gold.

Mineable stopes for underground Mineral Resource estimates were generated and evaluated using an MSO (Minable Shape Optimizer) software program at a stope cut-off grade of 1.5 g/t gold. Unclassified blocks, beyond Measured, Indicated and Inferred categories, due to a lack of sufficient drilling density were conservatively assumed 0 g/t grade in the stope evaluation. Subject to additional infill drilling, portions of these unclassified blocks may become economic and add to the existing Mineral Resource. The mineable shapes (MSO stopes) at both Nkran and Abore also respond well to multiple cut-off grades and show potentially good scalability in response to different economic and operational conditions (see Table 1 below with the base case for underground Mineral Resource estimates highlighted).

Table 1: Sensitivity of MSO Stope Tonnage, Grade and Ounces to Various Stope Cut-Off Grades

| MSO Stope Cut-off Grade (g/t) |

Indicated Mineral Resource | Inferred Mineral Resource | ||||

| Tonnes (000’s) |

Grade (g/t) |

Ounces (000’s) |

Tonnes (000’s) |

Grade (g/t) |

Ounces (000’s) |

|

| 1.0 | 5,217 | 2.23 | 375 | 11,978 | 1.95 | 750 |

| 1.2 | 4,369 | 2.45 | 344 | 9,209 | 2.19 | 647 |

| 1.4 | 3,728 | 2.64 | 316 | 7,279 | 2.41 | 563 |

| 1.5 | 3,444 | 2.74 | 303 | 6,489 | 2.52 | 525 |

| 1.6 | 3,169 | 2.83 | 289 | 5,786 | 2.62 | 488 |

| 1.8 | 2,663 | 3.04 | 261 | 4,601 | 2.85 | 421 |

| 2.0 | 2,213 | 3.27 | 233 | 3,656 | 3.08 | 362 |

Mineralization at Nkran and Abore remains open along strike and at depth beyond the current extent of exploration drilling (see images below). Various options to expedite exploration and aggressively expand the underground Mineral Resources through drilling are being assessed, which may include an investment decision on the opening of underground access.

Image 1: Nkran Long Section View of 1.5 g/t Cut-Off Grade MSO Stopes and Drillholes below Mineral Reserve Pit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/283757_galianoimg1.jpg

Image 2: Abore Long Section View of 1.5 g/t Cut-Off Grade MSO Stopes and Drillholes below Mineral Reserve Pit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/283757_galianoimg2.jpg

BUSINESS STRATEGY AND GROWTH INITIATIVES

The Company’s strategic priority is to grow its business into a sustainable mid-tier gold producer, with a focus on organic growth and mine life extension at the AGM through continued success in our exploration strategies, as well as accretive acquisition opportunities. These objectives are underpinned by the Company’s capital allocation strategy, which focuses on deployment of capital to grow the AGM’s production profile, extend its mine life, maximize asset value, and ultimately return capital to shareholders. The Company’s current growth initiatives are captured under the following headings, which the Company believes will drive shareholder value over the short, medium and long-term.

Organic Growth at the AGM

Near-Term Organic Production Growth – Improved Throughput and Higher Grades from Abore

Installation of the secondary crushing circuit in July 2025, combined with improving grades from Abore, positions the AGM for meaningful near-term production growth. Mill throughput is expected to rise by approximately 15% in FY 2026, supported by higher-grade ore sourced from lower elevations of the Abore pit through 2026 and 2027. As a result, the Company forecasts an approximate 25% increase in FY 2026 production compared to FY 2025.

The AGM’s Abore deposit has grown over the past two years from a satellite deposit to one of the AGM’s cornerstone primary deposits, hosting open pit Probable Mineral Reserves of 9.3 Mt at 1.16 g/t for 346,000 ounces gold contained as of December 31, 2025, in addition to an underground Mineral Resource as described below.

Medium-Term Production Growth – Nkran

Following the depletion of open pit Mineral Reserves at Abore, the AGM is positioned to further increase its production profile by transitioning to the higher-grade Nkran deposit. As of December 31, 2025, the Nkran deposit hosts open pit Probable Mineral Reserves of 10.6 Mt at 1.67 g/t for 570,000 ounces gold contained. Waste stripping of Nkran Cut 3 is progressing on schedule, with steady-state ore delivery to the processing plant expected by early 2029. Once in full production, the Company anticipates annual gold production well above 200,000 ounces per annum.

Long-Term Growth – Underground Mining at Nkran and Abore

The known mineral deposits hosted along the four shear corridors at the AGM share common geological features, which control gold distribution and placement in the same regional tectonic setting. Importantly, these features are consistent with classic orogenic gold deposits that can extend kilometers in the vertical direction and are known to host long-life underground mines globally. In the past year, the Company’s brownfield exploration strategy has focused on testing the vertical extents of mineralization at Nkran and Abore by drilling beneath the open pit Mineral Reserve shells at these deposits.

On the back of successful exploration results to date, these deposits currently host underground Indicated Mineral Resources of 3.4 Mt at 2.74 g/t for 303,000 ounces gold contained and underground Inferred Mineral Resources of 6.5 Mt at 2.52 g/t for 525,000 ounces gold contained as of December 31, 2025, highlighting the scale and growth potential of the underground system below the existing open pit operations.

These initial underground Mineral Resources confirm that mineralization continues below the current open pit limits, with sufficient volume, grade and geometry to potentially support economic extraction. Importantly, mineralization at both deposits remains open along strike and at depth, and further growth is expected with ongoing drilling planned for 2026. The Company’s immediate priority is to expand these underground Mineral Resources through step-out drilling and advance these deposits through mining studies toward Mineral Reserve classification, thereby extending the AGM’s mine life. These workstreams are targeted for completion within the next 12 to 24 months.

Long-Term Growth – Esaase Mineral Reserve Expansion

Given the extensive drilling completed at the Esaase deposit to date, and the relatively wide distribution of mineralization, it is uniquely positioned for rapid open pit Mineral Reserve expansion at current metal prices. The existing Mineral Reserve estimate is based on a long-term gold price of $1,900/oz; however, current drilling demonstrates that the Mineral Reserve continues to expand laterally and at depth without a material increase to strip ratios, up to and beyond metal prices of $2,500/oz. The objective of the Company’s 2026 drilling program at Esaase is to rapidly convert Inferred Mineral Resources contained within the $2,400/oz Mineral Resource shell and perform mining studies to significantly expand Esaase’s Mineral Reserve base. Such an expansion would extend the life of mine and provide an additional source of mill feed to complement potential underground ore production from Abore and Nkran. The Company expects to incorporate the results of this exploration program into the AGM’s December 31, 2026 Mineral Reserve estimate and revised life of mine plan.

Exploration

The Company continues to invest significantly in exploration at the AGM and has delivered meaningful results over the past three years, including the discovery of high-grade zones at the Abore Main and South pits and successful drilling beneath the existing Mineral Reserve boundaries at Nkran and Abore.

Over the next two to three years, the Company’s strategic objective is to add 1.0 million to 1.5 million gold ounces to the AGM’s combined open pit and underground Mineral Resources and Reserves, relative to the December 31, 2025 estimate, through continued brownfield and targeted greenfield exploration.

MINERAL RESERVE AND MINERAL RESOURCE STATEMENTS

The following tables outline the MRMR estimates for the AGM, effective December 31, 2025, December 31, 2024 and December 31, 2022, as applicable, including the maiden underground Mineral Resource estimates at the Nkran and Abore deposits. The updated MRMR incorporates extensive infill and step-out drilling conducted on the Abore deposit during 2025, which resulted in the replacement of virtually all depleted Mineral Reserves compared to the December 31, 2024 Mineral Reserve estimate.

AGM Mineral Resource and Mineral Reserve Estimates

Table 2: Mineral Resource Estimate as of December 31, 2025

| Deposit | Measured | Indicated | Measured + Indicated | Inferred | ||||||||

| Tonnes | Grade | Au Contained | Tonnes | Grade | Au Contained | Tonnes | Grade | Au Contained | Tonnes | Grade | Au Contained | |

| (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | |

| Open Pit (“OP”) Mineral Resources | ||||||||||||

| Nkran | – | – | – | 10.8 | 1.73 | 602 | 10.8 | 1.73 | 602 | 2.1 | 1.02 | 70 |

| Esaase | – | – | – | 33.0 | 1.19 | 1,266 | 33.0 | 1.19 | 1,266 | 12.2 | 1.15 | 449 |

| Abore | – | – | – | 10.5 | 1.15 | 388 | 10.5 | 1.15 | 388 | 0.3 | 0.61 | 7 |

| Miradani North | – | – | – | 7.9 | 1.39 | 352 | 7.9 | 1.39 | 352 | 2.9 | 1.30 | 122 |

| Midras South | – | – | – | 4.9 | 1.02 | 162 | 4.9 | 1.02 | 162 | 1.4 | 1.06 | 48 |

| Adubiaso | – | – | – | 2.6 | 1.36 | 113 | 2.6 | 1.36 | 113 | 0.4 | 0.76 | 10 |

| Dynamite Hill | – | – | – | 2.2 | 1.34 | 95 | 2.2 | 1.34 | 95 | 1.0 | 1.24 | 40 |

| Asuadai | – | – | – | 1.6 | 1.23 | 64 | 1.6 | 1.23 | 64 | 0.1 | 1.29 | 4 |

| Akwasiso | – | – | – | 1.4 | 1.16 | 52 | 1.4 | 1.16 | 52 | 0.2 | 1.28 | 9 |

| Stockpiles | 2.0 | 0.72 | 47 | – | – | – | 2.0 | 0.72 | 47 | – | – | – |

| OP Total | 2.0 | 0.72 | 47 | 74.9 | 1.28 | 3,094 | 77.0 | 1.27 | 3,141 | 20.7 | 1.14 | 758 |

| Underground (“UG”) Mineral Resources | ||||||||||||

| Nkran | – | – | – | 1.8 | 2.79 | 164 | 1.8 | 2.79 | 164 | 4.3 | 2.61 | 360 |

| Abore | – | – | – | 1.6 | 2.67 | 139 | 1.6 | 2.67 | 139 | 2.2 | 2.32 | 165 |

| UG Total | – | – | – | 3.4 | 2.74 | 303 | 3.4 | 2.74 | 303 | 6.5 | 2.52 | 525 |

| OP and UG Total | 2.0 | 0.72 | 47 | 78.4 | 1.35 | 3,397 | 80.4 | 1.33 | 3,444 | 27.2 | 1.47 | 1,283 |

Mineral Resource Notes:

- Mr. Eric Chen, P.Geo., Vice President Mineral Resources for Galiano Gold Inc., is the Qualified Person (as defined under NI 43-101) responsible for the open pit Mineral Resources statements of the Nkran, Esaase, Abore, Adubiaso, Akwasiso, Asuadai and Dynamite Hill deposits, and underground Mineral Resources statements of the Nkran and Abore deposits. Open pit Mineral Resources of Esaase and Adubiaso are reported within an optimized pit shell assuming a gold price of $2,400/oz and using various cut-off grades: 0.40 g/t gold in Oxides and 0.50 g/t gold in Transition and Fresh for Esaase, and 0.35 g/t gold for Adubiaso. Open pit Mineral Resources of Akwasiso, Asuadai and Dynamite Hill are reported within an optimized pit shell assuming a gold price of $1,800/oz and using cut-off grade of 0.45 g/t gold. Open pit Mineral Resources for Nkran and Abore are reported within the current reserve pit designs. Underground Mineral Resources of Nkran and Abore are reported below current reserve pit designs at 0 g/t cut-off grade of all materials contained inside MSO stopes, generated at 1.5 g/t gold economic cut-off grade, assuming a gold price of $2,400/oz. Metallurgical recovery of 94% is assumed for the Nkran, Adubiaso, Akwasiso, Asuadai and Dynamite Hill deposits. Metallurgical recovery for Abore assumes a constant tails grade of 0.10 g/t gold and capped at 94%. Metallurgical recovery for Esaase varies based on lithology and grade.

- Mr. Ertan Uludag, P.Geo., Director Mineral Resources for Galiano Gold Inc., is the Qualified Person (as defined under NI 43-101) responsible for the Mineral Resources statements of the Midras South and Miradani North deposits. Mineral Resources of Midras South are reported within an optimized pit shell assuming a gold price of $2,400/oz and using a cut-off grade of 0.35 g/t gold. Mineral Resources of Miradani North are reported within an optimized pit shell assuming a gold price of $1,800/oz and using a cut-off grade of 0.45 g/t gold. Processing recovery assumes 0.10 g/t gold residual tails with a maximum of 94.0% for Midras South and Stockpiles. Processing recovery for Miradani North assumes flat 94.0%.

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. All figures have been rounded to reflect the relative accuracy of the estimates. Due to rounding, some columns or rows may not compute exactly as shown.

- Open pit Mineral Resources are inclusive of Mineral Reserves.

- All tonnages are reported as in situ dry tonnes.

- All quantities are reported on a 100% basis.

- Mineral Resources for Nkran, Esaase, Abore, Adubiaso, Midras South and Stockpiles are stated with an effective date of December 31, 2025. Mineral Resources for Miradani North, Akwasiso, Asuadai, and Dynamite Hill are stated with an effective date of December 31, 2022.

Table 3: Mineral Reserve Estimate as of December 31, 2025

| Deposit | Proven | Probable | Total Proven and Probable | ||||||

| Tonnes (Mt) | Au Grade (g/t) |

Au Content (koz) | Tonnes (Mt) | Au Grade (g/t) |

Au Content (koz) | Tonnes (Mt) | Au Grade (g/t) | Au Content (koz) | |

| Open Pit | |||||||||

| Nkran | – | – | – | 10.6 | 1.67 | 570 | 10.6 | 1.67 | 570 |

| Esaase | – | – | – | 14.8 | 1.12 | 531 | 14.8 | 1.12 | 531 |

| Abore | – | – | – | 9.3 | 1.16 | 346 | 9.3 | 1.16 | 346 |

| Miradani North | – | – | – | 6.8 | 1.41 | 310 | 6.8 | 1.41 | 310 |

| Dynamite Hill | – | – | – | 1.1 | 1.31 | 45 | 1.1 | 1.31 | 45 |

| Adubiaso | – | – | – | 1.5 | 1.39 | 67 | 1.5 | 1.39 | 67 |

| Midras South | – | – | – | 1.4 | 1.12 | 49 | 1.4 | 1.12 | 49 |

| Stockpiles | 2.0 | 0.72 | 47 | – | – | – | 2.0 | 0.72 | 47 |

| Total | 2.0 | 0.72 | 47 | 45.5 | 1.31 | 1,918 | 47.5 | 1.29 | 1,965 |

Mineral Reserve Notes:

- Mineral Reserves are reported at the point of delivery to the process plant or to stockpile. All tonnages are reported as diluted dry metric tonnes. Mineral Reserves are reported using the 2014 CIM Definition Standards.

- The Nkran, Esaase, Abore and Stockpiles Mineral Reserves are stated as of December 31, 2025. The Adubiaso and Midras South are stated as of December 31, 2024. Miradani North and Dynamite Hill are stated as of December 31, 2022.

- Mineral Reserves are reported based on gold prices of $1,900/oz for Esaase, $1,700/oz for Nkran, Abore, Adubiaso, Midras South, and $1,500/oz for Miradani North and Dynamite Hill.

- Mineral Reserves for Adubiaso, Midras South, Miradani North and Dynamite Hill remain unchanged from the previous estimate dated December 31, 2024 and December 31, 2022. No new drilling, mining depletion, or other material information has occurred since that time.

- Cut-off grades vary by deposit and oxidation. All cut-off grades are applied to the fully diluted gold grade. The Mineral Reserves are reported at the following gold cut-off grades: 0.35 g/t for Nkran, 0.50 g/t for Abore, Miradani North, and Dynamite Hill, 0.60 g/t for Esaase, 0.40 g/t for Adubiaso and Midras South.

- Mineral Reserves are defined within pit designs guided by pit shells derived from the optimization software, HxGN MinePlan’s Minesight Economic Planner, GEOVIA Whittle™ and Datamine Studio NPVS™.

- Mining costs vary by pit, rock type, and pit depth. The base mining costs for Nkran, Esaase, Miradani North, Abore, Dynamite Hill, Adubiaso and Midras South are $2.63/t, $2.26/t, $1.94/t, $2.03/t, $2.29/t, $2.03/t, and $2.03/t respectively. Additional costs include fixed monthly contractor fees, grade control, community fees, owner’s mining general and administrative, and other minor costs that vary by deposit and are in addition to the stated unit costs.

- Processing assumptions range in unit costs from $8.81/t ore to $11.52/t ore.

- General and administration cost assumptions range in unit costs from $5.17/t to $6.69/t ore.

- Ore transportation cost varies for each pit based on the haul distance. It ranges between $0.61/t ore to $5.57/t ore.

- Processing recovery assumes 0.10 g/t gold residual tails with a maximum of 94.0% for Nkran, Abore, Adubiaso, Midras South, Stockpiles and Esaase oxides. Processing recovery for Esaase transition and fresh ore vary by head grade and lithology, and average 76% for upper and central sandstones, and 72% for cobra. Processing recovery for Dynamite Hill and Miradani North assume flat 94.0%.

- Mining dilution varies between pits, with average dilution ranging from 6.0% at Miradani North to 19.0% at Abore. Mining ore loss varies between pits, with average ore loss ranging from 2.0% at Miradani North to 11.7% at Midras South.

- Mining ore loss varies between pits. The average mining ore loss is calculated to be 3.7%, 2.0%, 2.0%, 6.2%, 2.0%, 3.7% and 11.7%, for Nkran, Esaase, Miradani North, Abore, Dynamite Hill, Adubiaso and Midras South, respectively.

- The overall strip ratio (the amount of waste tonnes mined for each tonne of ore) for the AGM is 7.4:1. The strip ratio for Nkran, Esaase, Miradani North, Abore, Dynamite Hill, Adubiaso and Midras South are 12.5, 6.2, 5.6, 4.5, 9.8, 9.3, and 6.9, respectively.

- Figures are rounded to the appropriate level of precision for the reporting of Mineral Reserves. Due to rounding, some columns or rows may not compute as shown.

- Mining cost inputs are in US$/t mined. All other unit cost inputs are US$/t ore.

- Mr. Amri Sinuhaji, P.Eng., Vice President Technical Services for Galiano Gold Inc., is the Qualified Person (as defined under NI 43-101) responsible for the Mineral Reserve estimates.

- Factors that could change the mine plans or reduce the amount of the mineral reserves include: Unrecognized geological structures that may displace mineralized zones and force unanticipated changes to the mine plan, changes in metal price and exchange rate assumptions; changes in local interpretations of mineralization; changes to assumed metallurgical recoveries, mining dilution and recovery; and assumptions as to the continued ability to access the site, retain mineral and surface rights titles, maintain environmental and other regulatory permits, and maintain the social license to operate.

Qualified Person

Mr. Eric Chen, P.Geo., Vice President Mineral Resources of Galiano, is a Qualified Person as defined by Canadian National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”), and has reviewed and approved the Mineral Resources statement.

Mr. Amri Sinuhaji, P.Eng., Vice President Technical Services with Galiano, is a Qualified Person as defined by NI 43-101 and has approved the Mineral Reserve statement and, except for the Mineral Resources statement, all other scientific and technical information contained in this news release. Mr. Sinuhaji has verified the underlying mine plans, geological models, and modifying factors, including mining, processing, metallurgical, and economic parameters, and approves the disclosure of this information.

Mr. Chris Pettman, P. Geo., Vice President Exploration of Galiano, is a Qualified Person as defined by NI 43-101 and has reviewed and approved any forward-looking exploration statements.

About Galiano Gold Inc.

Galiano is focused on creating a sustainable business capable of value creation for all stakeholders through production, exploration and disciplined deployment of its financial resources. The Company owns the Asanko Gold Mine, which is located in Ghana, West Africa. Galiano is committed to the highest standards for environmental management, social responsibility, and the health and safety of its employees and neighbouring communities. For more information, please visit www.galianogold.com.

Contact Information

Darshan Sundher

Toll-Free (N. America): 1-855-246-7341

Email: info@galianogold.com

Cautionary Note Regarding Forward-Looking Statements

Certain statements and information contained in this news release constitute “forward-looking statements” within the meaning of applicable U.S. securities laws and “forward-looking information” within the meaning of applicable Canadian securities laws, which we refer to collectively as “forward-looking statements”. Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future conditions and courses of action. All statements and information other than statements of historical fact may be forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as “seek”, “expect”, “anticipate”, “budget”, “plan”, “estimate”, “continue”, “forecast”, “intend”, “believe”, “predict”, “potential”, “target”, “may”, “could”, “would”, “might”, “will” and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook.

Forward-looking statements in this news release include, but are not limited to: statements regarding the Company’s operating and development plans for the AGM and timing thereof; expectations and timing with respect to current and planned drilling programs, including at Abore, Nkran and Esaase, and the results thereof; the focus, scope and anticipated results of the 2026 exploration program; the objective to increase Mineral Reserves, including any targets for additions to Mineral Reserves through exploration activities; expectations regarding reporting of an underground Mineral Reserve, including timing thereof; expectations regarding the potential integration of underground mining with the AGM’s existing open-pit operations; anticipated production levels, throughput increases, and any related production or cost guidance. Such forward-looking statements are based on a number of material factors and assumptions, including, but not limited to: development plans and capital expenditures; the price of gold will not decline significantly or for a protracted period of time; the accuracy of the estimates and assumptions underlying Mineral Reserve and Mineral Resource estimates; the Company’s ability to raise sufficient funds from future equity financings to support its operations, and general business and economic conditions; the global financial markets and general economic conditions will be stable and prosperous in the future; the AGM will not experience any significant uninsured production disruptions that would materially affect revenues; the ability of the Company to comply with applicable governmental regulations and standards; the mining laws, tax laws and other laws in Ghana applicable to the AGM will not change, and there will be no imposition of additional exchange controls in Ghana; the success of the Company in implementing its development strategies and achieving its business objectives; the Company will have sufficient working capital necessary to sustain its operations on an ongoing basis and the Company will continue to have sufficient working capital to fund its operations; and the key personnel of the Company will continue their employment.

The foregoing list of assumptions cannot be considered exhaustive.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and you are cautioned not to place undue reliance on forward-looking statements contained herein. Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this news release, include, but are not limited to: the Mineral Reserve and Mineral Resource estimates may change and may prove to be inaccurate; exploration activities may not result in the delineation of additional Mineral Resources or the conversion of Mineral Resources into Mineral Reserves within anticipated timeframes, or at all; life of mine estimates are based on a number of factors and assumptions and may prove to be incorrect; actual production, costs, returns and other economic and financial performance may vary from the Company’s estimates in response to a variety of factors, many of which are not within the Company’s control; inflationary pressures and the effects thereof; sustained increases in costs, or decreases in the availability, of commodities consumed or otherwise used by the Company may adversely affect the Company; adverse geotechnical and geological conditions (including geotechnical failures) may result in operating delays and lower throughput or recovery, closures or damage to mine infrastructure; the ability of the Company to treat the number of tonnes planned, recover valuable materials, remove deleterious materials and process gold as planned is dependent on a number of factors and assumptions which may not be present or occur as expected; risks related to artisanal and illegal mining activities at or near the AGM, including that the Company’s mineral properties may experience a loss of ore, and the Company may experience lack of access to its mineral properties and other issues, due to illegal mining activities; the Company’s operations may encounter delays in or losses of production due to equipment delays or the availability of equipment; the ability of the Company to manage procurement risks, including securing timely and cost-effective equipment and services, and mitigate risks related to supplier performance, fraud, collusion, bribery, kickbacks and unethical procurement practices; outbreaks of infectious diseases may have a negative impact on global financial conditions, demand for commodities and supply chains and could adversely affect the Company’s business, financial condition and results of operations and the market price of the common shares of the Company; the Company’s operations are subject to continuously evolving legislation, compliance with which may be difficult, uneconomic or require significant expenditures; the Company may be unsuccessful in attracting and retaining key personnel; labour disruptions could adversely affect the Company’s operations; metallurgical recoveries may not be economically viable or recoveries may be lower in the future and have a negative impact on the Company’s gold production and financial results; the Company’s business is subject to risks associated with operating in a foreign country; risks related to the Company’s use of mining and other contractors; the hazards and risks normally encountered in the exploration, development and production of gold; the Company’s operations are subject to environmental hazards and compliance with applicable environmental laws and regulations; the effects of climate change or extreme weather events may cause prolonged disruption to the delivery of essential commodities which could negatively affect production efficiency; the Company’s operations and workforce are exposed to health and safety risks; unexpected costs and delays related to, or the failure of the Company to obtain, necessary permits could impede the Company’s operations; the Company’s title to exploration, development and mining interests can be uncertain and may be contested; geotechnical risks associated with the design and operation of a mine and related civil structures; the Company’s properties may be subject to claims by various community stakeholders; risks related to limited access to infrastructure and water; risks associated with establishing new mining operations; the Company’s revenues are dependent on the market prices for gold, which have recently experienced significant fluctuations; the Company may not be able to secure additional financing when needed or on acceptable terms; the Company’s shareholders may be subject to future dilution; risks related to changes in interest rates and foreign currency exchange rates; changes to taxation laws applicable to the Company may affect the Company’s profitability and ability to repatriate funds; risks related to the Company’s internal controls over financial reporting and compliance with applicable accounting regulations and securities laws; risks related to information systems security threats; non-compliance with public disclosure obligations could have an adverse effect on the Company’s share price; the carrying value of the Company’s assets may change and these assets may be subject to impairment charges; risks associated with changes in reporting standards; the Company may be liable for uninsured or partially insured losses; the Company may be subject to litigation; damage to the Company’s reputation could result in decreased investor confidence and increased challenges in developing and maintaining community relations which may have adverse effects on the business, results of operations and financial conditions of the Company and the Company’s share price; the Company may be unsuccessful in identifying targets for acquisition or completing suitable corporate transactions, and any such transactions may not be beneficial to the Company or its shareholders; the Company must compete with other mining companies and individuals for mining interests; the Company’s growth, future profitability and ability to obtain financing may be impacted by global financial conditions; the Company’s common shares may experience price and trading volume volatility; the Company has never paid dividends and does not expect to do so in the foreseeable future; the Company’s shareholders may be unable to sell significant quantities of the Company’s common shares into the public trading markets without a significant reduction in the price of its common shares, or at all; and any such other risk factors described under the heading “Risk Factors” in the Company’s Annual Information Form.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in, or incorporated by reference in, this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither the Toronto Stock Exchange nor the Canadian Investment Regulatory Organization accepts responsibility for the adequacy or accuracy of this news release.

Source: Galiano Gold Inc.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283757