Vancouver, British Columbia–(Newsfile Corp. – January 12, 2026) – Gold X2 Mining Inc. (TSXV: AUXX) (OTCQB: GSHRF) (FSE: DF8) (“Gold X2” or the “Company“), is pleased to announce that it has signed a definitive agreement (the “Definitive Agreement“) with Sky Gold Corp. (“Sky Gold“) to acquire, in stages, Sky Gold’s interest in an option agreement (the “Option Agreement“) for the Star Lake claims (the “Star Lake Property“). The Star Lake Property covers 10,540 ha and is approximately 23 kilometers to the east of the Company’s Moss Gold Project in Northwest Ontario, Canada (the “Moss Gold Project“). Acquisition of the Star Lake Property would bring the Company’s total land package in the emerging Shebandowan Greenstone Belt to 40,456 hectares.

Michael Henrichsen, CEO of Gold X2 commented, “We are very excited to have assumed the option to explore the highly prospective undrilled Star Lake property. It represents the opportunity to make another major discovery in the emerging Shebandowan Greenstone Belt and is consistent with our plan to create an exploration pipeline as we build and consolidate our district scale land position.”

Highlights

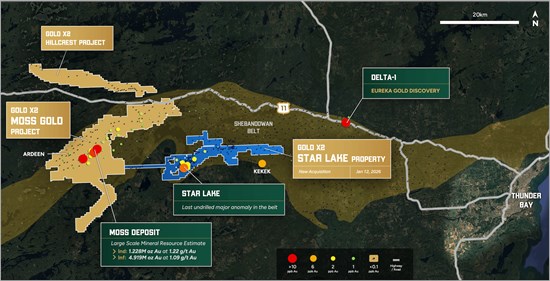

- The acquisition of the Star Lake Property would give Gold X2 control of three of the four significant gold-in-till anomalies defined by the Ontario Geological Survey’s regional till database across the Shebandowan Greenstone Belt.

- The other three gold-in-till anomalies are all associated with significant bedrock gold mineralization, including the Moss Gold Deposit, the historical Ardeen mine now owned by Gold X2, and the recent “Eureka Zone” discovery at Delta-1 owned by Delta Resources.

Figure 1: Illustrates the gold-in-till anomalies in the Shebandowan Greenstone Belt and the location of the Star Lake Property relative to the Moss Gold Deposit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/279984_109d9101e4d68a26_002full.jpg

Project Description

The execution of the Definitive Agreement for the option to acquire the Star Lake Property, covering 10,540 ha, demonstrates Gold X2’s focus on creating a highly prospective exploration pipeline within the emerging Shebandowan Greenstone Belt.

Star Lake hosts one of only four significant gold-in-till anomalies evident in the Ontario Geological Survey’s regional till geochemistry data for the entire Shebandowan greenstone belt. This was initially outlined in the Quetico Reconnaissance Project conducted by Mingold Resources in 1990 and augmented by subsequent explorers. These four clusters of anomalous gold-in-till samples surround the already discovered Moss Gold Project and the historical Ardeen mine, both controlled by Gold X2, the “Eureka Zone” at Delta-1 held by Delta Resources, and the undrilled gold-in-till anomaly at Star Lake held by Sky Gold. There is a fifth single sample anomaly at Kekek, but explorers have not been able to reproduce this anomaly.

The Star Lake till anomaly lies within the till train that lies to the southwest in the direction of glacial flow of the historical Shebandowan Nickel Mine, creating a large area of base metal anomalism. This directed historical exploration to focus on magmatic Ni-Cu-Co-PGE deposits. Sky Gold recognized the underlying gold potential as noted in their press release of April 10, 2024:

“Heavy mineral concentrates from the historic Mingold sampling at Star Lake yielded gold values as high as 5,250 ppb, 1,580 ppb, 1,370 ppb and 1,050 ppb over an area of approximately 3 X 3 kilometres. Delicate, pristine gold grains were also reported at several sample sites, strongly suggesting a local bedrock source for the gold. The high gold values in these samples, also include strongly anomalous pathfinder elements including arsenic, antimony, bismuth, as well as copper, lead and zinc.”

Additional till sampling by Sky Gold helped to define two distinct gold and pathfinder trains, associated with favourable geology and structural features which provide favorable settings for orogenic gold deposits:

- one mineralized trend runs parallel to an unnamed ENE-trending fault along the contact between intermediate volcanics and the Greenwater granodiorite stock; and

- a second trend runs parallel to the ENE-trending Tinto Fault along the contact of intermediate volcanics and a gabbroic intrusive body.

Surface prospecting and stripping have yet to discover the source of the gold anomaly. This will be the focus of the Company’s exploration programs in late 2026, which will start with a gradient array geophysical survey.

Deal Terms

Pursuant to the Definitive Agreement, signed on January 9th, 2026, Gold X2 has the right to earn 50%, 75% and 100% of Sky Gold’s interests in the Option Agreement (the “Option Interest“) between Sky Gold and a local prospector (the “Local Prospector“) on the terms outlined below. The Definitive Agreement, including all share issuances thereunder, remains subject to the approval of the TSX Venture Exchange (“TSXV“). Upon acquisition of 100% of the Option Interest Gold X2 will have the exclusive right to purchase a 100% interest in the mineral rights forming the Star Lake Property. Commencing from today, Gold X2 will be the operator of the Star Lake Property and will have the exclusive right to control all exploration work conducted on the property.

Stage 1 – Acquisition of 50% of the Option Interest: In order to acquire 50% of the Option Interest Gold X2 must: (i) provide $395,200 of assessment credits for the Stare Lake Property, which has been provided as of today; (ii) issue Sky Gold shares of Gold X2 having a total value of $75,000; (iii) pay the Local Prospector $200,000 in either cash or Gold X2 shares, at Gold X2’s election and issue the Local Prospector shares of Gold X2 having a total value of $25,000, in each case, by March 14, 2026; and (iv) complete Sky Gold’s exploration spend obligation under the Option Agreement totaling $1,000,000 on or before March 14, 2028.

Stage 2 – Acquisition of 75% of the Option Interest: In order to acquire 75% of the Option Interest Gold X2 must: (i) incur an additional $250,000 exploration spend on the Star Lake Property; (ii) issue Sky Gold shares of Gold X2 having a total value of $100,000; and (iii) issue the Local Prospector shares of Gold X2 having a total value of $50,000. There is no time limit to satisfy any of these obligations.

Stage 3 – Acquisition of 100% of the Option Interest: In order to acquire 100% of the Option Interest Gold X2 must: (i) incur an additional $250,000 exploration spend on the Star Lake Property; (ii) issue Sky Gold shares of Gold X2 having a total value of $125,000 and pay Sky Gold $250,000 in cash; and (iii) issue the Local Prospector shares of Gold X2 having a total value of $50,000. There is no time limit to satisfy any of these obligations.

Exercising the Option: Upon acquiring 100% of the Option Interest, Gold X2 may exercise its option to acquire the Star Lake Property by issuing the Local Prospector that number of Gold X2 shares having an aggregate value equal to the value of 125,000 shares of Sky Gold, determined as of the issuance date. Upon completion of the acquisition, the Local Prospector will retain a 2% NSR royalty on the Star Lake Property and Gold X2 will retain Sky Gold’s rights under the Option Agreement to purchase the NSR royalty from the Local Prospector in full for $3M. Additionally, Gold X2 will be required to make minimum and advance royalty payments to the Local Prospector of $20,000 yearly from 2030-2033.

All Gold X2 shares issued in connection with the Definitive Agreement will be subject to a hold period of four months and one day from the date of issuance, in accordance with applicable securities laws.

There are no finders’ fees or commissions payable in connection with the Acquisition. The Company confirms that there are no non-arm’s length parties involved in the agreement.

Company Update

The Company also announces that Michael Kanevsky, Gold X2’s Chief Financial Officer, has been appointed as Corporate Secretary of the Company. The Company is pleased to have Mr. Kanevsky assume this additional role and looks forward to his continued contributions to the Company. In connection with this appointment, Juciane Gomes will be stepping down as Corporate Secretary. The Company thanks Ms. Gomes for her dedication and valued service.

Qualified Person

Peter Flindell, PGeo, MAusIMM, MAIG, Chief Operating Officer of the Company, and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

About Gold X2 Mining

Gold X2 is a growth-oriented gold company focused on delivering long-term shareholder and stakeholder value through the acquisition and advancement of primary gold assets in tier-one jurisdictions. It is led by the ex-global head of structural geology for the world’s largest gold company and backed by one of Canada’s pre-eminent private equity firms. The Company’s current focus is the advanced stage 100% owned Moss Gold Project which is positioned in Ontario, Canada, with direct access from the Trans-Canada Highway, hydroelectric power near site, supportive local communities and skilled workforce. The Company has invested over $75 million of new capital and completed approximately 100,000 meters of drilling on the Moss Gold Project, which, in aggregate, has had over 255,000 meters of drilling. The 2024 updated NI 43-101 mineral resource estimate (“MRE”) has expanded to 1.54 million ounces of Indicated gold resources at 1.23 g/t Au, contained within 38.96 million tonnes and 5.20 million ounces of Inferred gold resources at 1.11 g/t Au, contained within 146.24 million tonnes. The MRE only encompasses 3.6 kilometers of the 35+ kilometer mineralized trend, remains open at depth and along strike and is one of the few remaining major Canadian gold deposits positioned for development in this cycle. Please see NI 43-101 technical report titled: “Technical Report and Updated Mineral Resource Estimate for the Moss Gold Project, Ontario, Canada,” dated March 20, 2024 with an effective date of January 31, 2024 available under the Company’s SEDAR+ profile at www.sedarplus.ca. For more information, please visit SEDAR+ (www.sedarplus.ca) and the Company’s website (www.goldx2.com)

For More Information – Please Contact:

Michael Henrichsen

President, Chief Executive Officer and Director

Gold X2 Mining Inc.

E: mhenrichsen@goldx2.com

W: www.goldx2.com

T: 1-604-404-4335

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Forward-looking statements in this news release include, among others, statements that the acquisition of the Star Lake Property would increase the total land package as disclosed; that the acquisition of the Star Lake Property would give Gold X2 control of three of the four significant gold-in-till anomalies defined by the Ontario Geological Survey’s regional till database across the Shebandowan Greenstone Belt; that the mineralization systems at the Star Lake Property offer excellent potential at discovering new high grade, low tonnage mineralization that may compliment a mining scenario at the Moss Gold Project; that the Company will focus on discovering the source of the gold anomaly at the Star Lake Property in late 2026, which will start with a gradient array geophysical survey; that Gold X2 will be the operator of the Star Lake Property from today onwards; that upon acquiring 100% of the Option Interest, Gold X2 will have the right to acquire the Stare Lake Property; and other statements that are not historical facts.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: that the acquisition of the Star Lake Property would fail to increase the total land package as disclosed; that the acquisition of the Star Lake Property would fail to give Gold X2 control of three of the four significant gold-in-till anomalies defined by the Ontario Geological Survey’s regional till database across the Shebandowan Greenstone Belt, because of title issues or other unanticipated issues; that the mineralization systems at the Star Lake Property will fail to result in the discovery of new high grade, low tonnage mineralization that compliment a mining scenario at the Moss Gold Project; that the Company will fail to carry out its exploration plans on the Star Lake Property in 2026 as anticipated; the occurrence of an event or circumstance that prevents Gold X2 from operating the Star Lake Property; that Gold X2 will fail to receive TSXV approval for the Definitive Agreement; risks related to exploration, development, and operation activities; exploration and development of the Star Lake Property will not be undertaken as anticipated; the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; the Company’s exploration work may not deliver the results expected; the fluctuating price of gold; unknown liabilities in connection with the acquisition of the Star Lake Property; compliance with extensive government regulation; delays in obtaining or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory requirements; applicable laws and regulations could adversely affect the Company’s business and results of operations; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; the Company’s limited operating history; intervention by non-governmental organizations; outside contractor risks; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance; and other risks associated with executing the Company’s objectives and strategies as well as those risk factors discussed in the Company’s continuous disclosure documents filed under the Company’s SEDAR+ profile at www.sedarplus.ca.

The forward-looking information in this news release is based on management’s reasonable expectations and assumptions as of the date of this news release. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding: that the acquisition of the Star Lake Property would increase the total land package as disclosed; that the Company’s belief that the mineralization systems at the Star Lake Property offer excellent potential at discovering new high grade, low tonnage mineralization that may compliment a mining scenario at the Moss Gold Project will prove to be accurate; that the Company will carry out its exploration plans on the Star Lake Property in 2026 as anticipated; that nothing will prevent Gold X2 from operating the Star Lake Property; that Gold X2 will receive TSXV approval for the Definitive Agreement; the future price of gold; anticipated costs and the Company’s ability to fund its programs; the Company’s ability to carry on exploration, development and mining activities; prices for energy inputs, labour, materials, supplies and services; the timing and results of exploration programs; the timely receipt of required approvals and permits; the costs of operating and exploration expenditures; the Company’s ability to operate in a safe, efficient, and effective manner; the Company’s ability to obtain financing as and when required and on reasonable terms; that the Company’s activities will be in accordance with the Company’s public statements and stated goals; that the Company’s exploration work will deliver the results expected; and that there will be no material adverse change or disruptions affecting the Company or its properties.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/279984