“Mozambique Opening New Opportunities for Oil and Gas Development, Tenders, R&D” – Tivane, ENH’s Local Content Director

Victor Tivane, the local content director of Empresa Nacional de Hidrocarbonetos (ENH) – Mozambique’s state-owned hydrocarbon company, speaking in an exclusive interview with Ndubuisi Micheal Obineme, Managing Editor of The Energy Republic, disclosed that Mozambique has entered a new era for oil and gas development, creating opportunities for investment including tenders for projects, research and development (R&D).

As a result of this development, Victor Tivane is set to launch a book titled: “Local Content in the Oil and Gas Sector & Mozambique Sustainable Development”, which features insights into Mozambique’s Hydrocarbon & Energy Sector; Projects; Stakeholders and Demand for Goods and Services; Ownership and Access to Hydrocarbon Reserves and Natural Resources; Gas Master Plan and Domestic Gas Terms of Reference.

According to Tivane, the book will be launched by June 2024.

Excerpts:

TER: Please tell us about yourself.

Tivane: I was born on March 13, 1965 in Mozambique. I have a degree in Geology from Eduardo Mondlane University (UEM – Portuguese acronym), and Business Management from the University of South Africa (UNISA).

I also took several medium and short-term training courses at several Universities and Training Centers located in Europe (Dublin, Aberdeen, and London), the USA (Silicon Valley and Denver), Latin America (São Paulo, Rio de Janeiro and Brasília) and Africa (Johannesburg, Cidade da Praia and Cairo) which led me to train in disciplines ranging from Local Content Development in the Oil and Gas Sector, Investment Attraction Techniques, Training Programs for Small and Medium Enterprises and Development of Industrial Parks.

I have also participated at several International Oil and Gas Forums, either as a Speaker or as a Participant.

My professional experience, which spans more than 15 years, includes the Promotion and Development of Local Content in the Oil and Gas sector; Development and Operationalization of Initiatives that aim to elevate Small and Medium Enterprises and their linkage to other economic sectors as well as the Promotion of Foreign Direct Investment including Industrial Free Zones and Industrial Parks.

Regarding my experience in the oil and gas sector, it is important to say that it reached its highest point in 2017 when I was appointed to operate the Local Content Office at the Mozambique National Oil Company having committed to creating strategies for the participation of indigenous companies in the Oil and Gas sector. It should be remembered that Mozambique is considered an emerging country in the Oil and Gas sector, with the consequences that this entails, namely deficient policies and strategies for local content and at the same time local companies and a workforce with little preparation to participate in the sector.

As Director of the Local Content Area, my main task was to lead and coordinate the operation of the Company’s policy on Local Content development, as well as create strategies for the involvement of local companies in the Oil and Gas sector, to ensure the acceleration of skills and technology transfer in the context of large investments in the sector.

In this context, I created and operationalized the LinKar Program (which was derived from Link), budgeted at 26 million US dollars, financed mainly by the African Development Bank (AfDB) and the United States Agency for International Development (USAID), whose objective was to provide indigenous companies with information about the oil and gas sector, provide technical and financial capacity, facilitate partnerships or joint ventures with regional companies that have experience in the sector and facilitate linkages for the supply of goods and services to the oil and gas sector.

TER: You have a strong footprint in the Mozambique oil and gas industry coupled with your working experience at the ENH, Mozambique’s state-owned hydrocarbon company. What’s the current state of Mozambique’s hydrocarbon sector?

Tivane: Mozambique is the 13th country in the world with more fossil fuel reserves. Only in 2012, there were discoveries of more than 100 billion cubic feet of natural gas on national soil. The northern region of the Rovuma River, in the Cabo Delgado province, is today the most promising for the development of the oil and gas sector in the country.

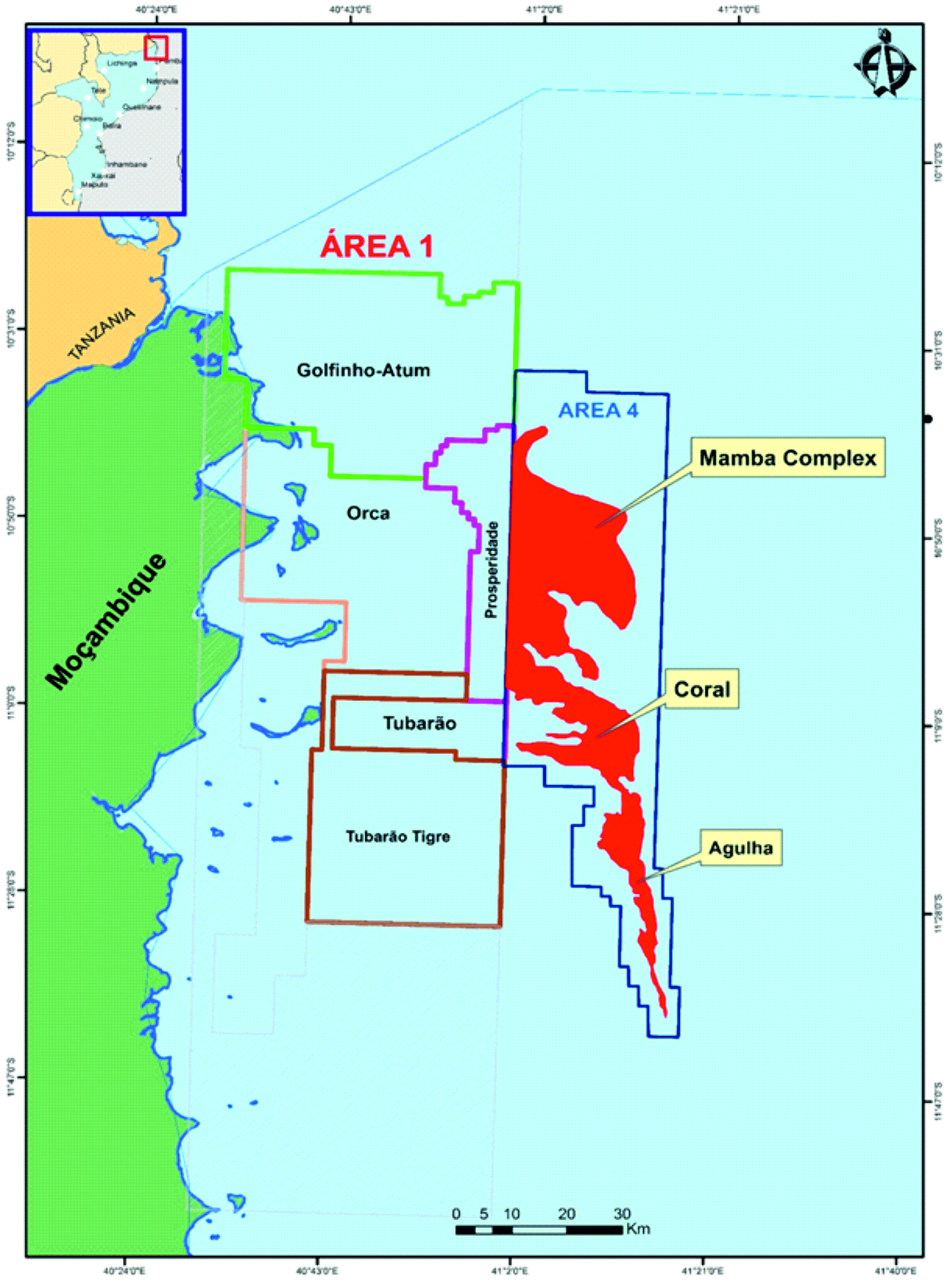

Fig. 1 – Location of the main gas fields in the Rovuma Basin

In 2010, it was officially announced the discovery of 33-38 trillion cubic feet of recoverable natural gas along the coast in the Rovuma basin and the current investment amounts to about $25 billion for the development of a value chain that includes the integration of the industries to the gasification centers.

In geological terms, the hydrocarbons in Mozambique are concentrated in areas of sedimentary rock accumulation called Sedimentary Basins and thus have six large sedimentary basins, namely:

- Mozambique Basin

- Rovuma Basin

- Lake Niassa Basin

- Maniamba Basin

- Middle Zambezi Basin

- Lower Zambezi Basin

The coastal basins of Mozambique and Rovuma constitute the main sedimentary basins in the country, both in terms of volume of accumulated sediments and hydrocarbon occurrences, where hydrocarbon research activities are concentrated.

The Mozambique Basin extends along the coastal plain of central and southern Mozambique. The sedimentary rocks that occur in this Basin were deposited between the Carboniferous and Quaternary periods.

On the other hand, the Rovuma Basin is located in the North of Mozambique occupying more than 60,000 km from the continental coastal zone to the maritime zone. The sediments in this Basin were deposited between the Jurassic and Quaternary periods.

Hydrocarbon research and production activities began in 1904 when the first explorers discovered in Mozambique sedimentary basins onshore. Weak technology and lack of funds prevented previous research attempts (National Petroleum Institute, 2012).

Beginning in 1948, international oil and gas companies entered Mozambique and started extensive land surveys, but without covering the offshore areas.

In 1961, the Pande Gas Field, discovered by Gulf Oil, was the first field to be discovered in the country. This was followed by the Búzi and Temane gas fields in 1962 and 1967, respectively.

The research activity in the Pande/Temane Block by another operator led to the discovery of the Inhassoro Gas Field, all located in Inhambane Province, in southern Mozambique.

Between 1990 and 2003 research activities were carried out in the Pande and Temane fields, including 2D seismic acquisition and drilling of eight pioneer wells (six onshore and two offshore).

Ground gas resources in Inhambane Province have been exploited since 2004. Natural gas is exported to South Africa and is also used to supply the local market in Mozambique (Matola Industrial Park in Maputo Province).

In the Sofala and Inhambane Provinces, research activities (seismic and/or drilling) were carried out in Blocks M-10 and Sofala in 1998 and 2007 by Arc and Bang, respectively.

Both blocks have already been acquired and seismic and drilling research activities are maintained within blocks 16 and 19 including M-10 and Sofala, which is around the Provinces of Sofala and Inhambane.

For Area A onshore, in Inhambane Province, it was proposed to perform seismic acquisition followed by well drilling.

Hydrocarbon research in Cabo Delgado Province in northern Mozambique, and specifically in the Mocímboa de Praia and Palma Districts, began in the 1980s by French and American companies, and the results were later analyzed by Artumas.

In 2008, Artumas carried out the seismic acquisition and drilling of research wells to confirm whether or not hydrocarbons existed in commercially viable quantities in the Rovuma Basin Earth Block. Natural gas was found in a well drilled in Mocímboa da Praia (MOC-1). This Block was acquired by AMA1 (Anadarko Moçambique Área 1, Lda), which has carried out similar research activities in recent years.

In the Rovuma Basin offshore, research activities were carried out by several operators in offshore blocks, namely: AMA1 (Area 1), Eni (Area 4), Equinor (formerly Statoil) in (Areas 2 and 5) and Petronas Carigali Mozambique Rovuma Basin Limited (PCMRB) in (Areas 3 and 6).

The hydrocarbon monetization in Mozambique is present in the Mozambican and Rovuma Sedimentary Basins with six projects, namely Pande and Temane Project, Area 1 (Dolphin Tuna, Orca, Prosperity, Shark and Tiger shark) and Area 4 (Coral FLNG and Mamba).

TER: Interestingly, you will be launching a Book in July 2024 about the Mozambique oil and gas industry. At what point did you decide to be an author and what were your key findings that led to the production of the book?

Tivane: Before answering your question, I would like to inform you that as a geologist I was very interested in publicizing the mineral resource projects in which I am involved.

Before now, 14 years ago, I was involved in a bottled water Project, known as Mineral Waters, through a company of which I was a partner and I wrote a book regarding bottled water in terms of its research, production, processing, marketing commercialization, as well as the good practices.

For the “Local Content in the Oil and Gas Sector & Mozambique Sustainable Development”, I started writing in 2017. The content reflects my practical experience in addition to my academic experience.

I am diving into the depths of this extractive industry intending to bring to the surface the technical secrets, policies, management, benefits, and strategies for achieving sustainable development in Mozambique.

The content published in my book is of maximum interest to authorities linked to the sector, including industry players and academics. My main target audience is the private sector with the current focus on other sectors, the communities surrounding oil and gas projects as well as the general public.

This book, I believe would provide the required tool that can expose the Mozambique oil and gas industry in such a way that in the next 30-50 years, the country could make a big difference if its oil and gas resources are managed with excellence. The content in the book also provides more insight into the risks that may arise, creating political tensions, including economic and social instability if the resources aren’t managed efficiently.

TER: What is the main content in the Book?

Tivane: The Book, with 275 pages, has eight chapters, as follows:

I. Main National Objectives of Mozambique;

II. Hydrocarbon Geology, Exploration, Development and Production;

III. Principles of Hydrocarbon Management;

IV. The Hydrocarbons Sector in Mozambique;

V. Country’s Commitment to Local Content;

VI. Structure and Specificity of Local Content;

VII. Global Initiatives and Local Content Lessons; and

VIII. Local Content and the Roadmap for its Development.

TER: How important is the Book to drive Mozambique’s sustainable development?

Tivane: Several studies show that Mozambique’s industrial capacity is currently limited, giving rise to an economic structure highly dependent on imports, duly exacerbated by an increase in domestic demand for manufactured goods and foreign capital.

For example, in terms of the country’s total imports in 2013, 84.2% were manufactured goods. In this context, this industrial and commercial structure with strong dependence on imported production factors contributes to the increase in the current economic deficit.

Furthermore, the country is characterized by poor development in its infrastructure, such as roads, bridges, etc. and the predominant agriculture is still subsistence.

However, a new opportunity is opening in Mozambique, which is the discovery of large reserves of natural gas, which needs to be properly managed.

However, it is important to mention that the challenge for developing countries, such as Mozambique, is to create strategies to make the most of the exploitation of this important resource to benefit the growth of other sectors of the economy through the development of local companies, increasing local skills and acceleration of technology transfer.

However, when observing other geographies, it appears that many countries, at the beginning of their exploration activities in the sector, seem to have faced adversities from the point of view of the conception and implementation of ‘Policies’ that can contribute to the growth of other sectors of the economy and at the same time local companies and communities faced many difficulties in being included due to the demanding nature of the Oil and Gas sector.

My book titled: “Local Content in the Oil and Gas Sector & Mozambique Sustainable Development”, also features my contributions on the strategies and business model options that can be followed so that the extractive industry sector can contribute positively to leveraging other sectors of the economy while focusing on Local Content.

TER: What specific areas are covered in the Book in terms of the Roadmap for Mozambique’s local content development?

Tivane: Some chapter from the book proposes a model for designing a local content policy from the country’s resource base in terms of the petroleum activities, as well as capacity levels available in the country with an orientation towards national development.

My book seeks to support policymakers from emerging producing countries, with a sequential structure that considers the multiple factors that come into play in the development of a local content policy.

A simple Local Content roadmap analyzes expected demand from the oil sector (depending on whether the country is in the exploration phase, post-discovery onshore or offshore, or single or multiple projects) and existing national capabilities (skills, infrastructure, supporting industries).

Local content policy considerations are typically presented in a decision tree format to highlight their relationship to the sequence of geological stages typical of emerging producers as they move from exploration to discovery and then to production.

Local content policies, despite being formulated to benefit emerging host countries, often fail to achieve their objectives. There is a history that shows those countries capturing and retaining more value in the exploitation of their natural resources.

The ‘resource curse’ and issues linked to ‘Dutch disease’ are prominently addressed in economic literature.

Furthermore, there are frequent reports of multinationals offering low-skilled jobs to locals, while foreigners get and keep well-paying jobs because they require experience and sophisticated technological training.

However, there is increasing public pressure in many well-established and emerging producing countries for governments to pressure multinationals to create employment opportunities and business opportunities for locals.

As a result of several countries in Sub-Saharan Africa, the business connections developed are often superficial in terms of contractual dimension and are often nothing more than propaganda.

TER: As the local content director of ENH, what’s the percentage of local content in the Mozambique oil and gas industry; and, what are your perspectives on strategies to increase it more especially in other value chains of the oil and gas industry in-country?

Tivane: First of all, it is important to clarify that Mozambique is currently in the development stage with regard to Local Content in the Oil and Gas sector, both in the form of Policies and Legislation and in terms of Actions to materialize national participation in the sector. I mean that the existing legal framework in Mozambique that relates to Local Content or Local Content issues is decentralized at the sectoral level and does not coherently address this matter. Instead, topics related to Local Content are found scattered across various laws and regulations and are not explicitly identified.

While there is no primary legal and policy framework that guides local content requirements and programs in Mozambique, there are important policy and legal frameworks already in place that support the development of local content (LC), or even explicitly contain provisions of Local Content as the obligation (requirement) in the local search for products, services and labor.

Although Local Content is not an explicit area of focus in development plans and strategies for Mozambique, a favorable business environment and private sector growth are priorities in the country’s policies. Thus, a business environment conducive to private sector development has been fundamental in structuring and supporting local content initiatives.

It should be added that in Mozambique there is still no consensual definition of Local Content. This often contributes to the confusion in the debate surrounding Local Content development.

As previously mentioned, strictly defined Local Content refers to the percentage of a product whose added value originates in the domestic market (within the country), while the more common definition of Local Content, sometimes referred to as Local Sourcing in terms of the purchase of goods or services from a local supplier.

Local Content in Mozambique encounters similar definitional issues. There is no clear and unique definition for Local Content in Mozambique.

In general, most conversations about Local Content are focused on defining Local Content as the acquisition of goods or services from local suppliers.

What constitutes “local” is still in dispute. It may simply be the name of a company that operates in the country or it may be associated with the criteria used to define what a “Mozambican” company is.

In the latter case, there are different requirements regarding what constitutes a “Mozambican” company. There is still no single definition in Mozambique.

But, in percentage terms, there is no information on Local Content only the amount disbursed for the purchase of goods and services provided by indigenous companies and foreign companies.

Based on the experiences of other geographies as well as the current framework of the political economy of Mozambique, combined with the pressure to act in the area of local content and the need to agree on the definition and vision of local content, which advocates that the country should consider developing a Local Content Policy Framework.

This option would make it easier to address the fundamental aspects of local content and allow the Government to develop a unified and coordinated approach, rather than an approach that is ad-hoc and confusing to the private sector.

This approach would also allow the private sector and civil society to participate in the drafting of this Policy and thus use it as a platform to create a common understanding.

TER: What are the business opportunities highlighted in the Book to attract foreign companies and investors to explore the opportunities in Mozambique’s oil and gas industry?

Tivane: The book includes a Chapter on the Hydrocarbon Sector in Mozambique, which in turn includes four sub-titles, namely The Energy Sector in Mozambique; Main Projects, Stakeholders and Demand for Goods and Services; Ownership and Access to Hydrocarbon Reserves and Natural Resources; and Gas Master Plan and Domestic Gas Terms of Reference.

Your question can be answered by diving into two sub-headings, namely Stakeholders and Demand for Goods and Services and the Natural Gas Master Plan and Domestic Gas Terms of Reference, where we can view the goods and services that will be required during the implementation of Gas Projects, both in the Rovuma basin and in Mozambique and the opportunities that open up with the operationalization of gas projects, which includes the use of gas for the implementation of a fertilizer factory, thermal power plant, petrochemical industry, GTL, etc.

However, opportunities for investors in the Mozambique oil and gas sector include launching tenders for the research and exploration of future blocks for oil and gas discoveries.

TER: In terms of project development, are there specific projects published in the Book?

Tivane: The book covers projects both in their exploration, development, and production phases.

The book also provides more information on projects located in the Mozambique Basin and those in the Rovuma Basin, with information in terms of reserves, development, and Production plans, as well as the companies involved.

TER: When do you intend to launch the Book officially and how can the members of the public access it?

Tivane: The scheduled date for the physical release of the book is by June 2024. But the electronic version is available on the Amazon.com platform, where people can easily purchase a copy of the book.