The global economy is cautiously walking away from the shadow of the unprecedented challenge of the COVID-19 pandemic. The GECF is observing a reset of the world energy outlook for the longer term and is finding it imperative to take part in the imminent and accelerated energy transition towards a less carbon-intensive energy mix, which envisions a cleaner, environmentally more friendly future.

LNG might be the last great opportunity in the oil and gas industry. LNG trade has been historically showing remarkable development over the past two decades with over 3.5 times growth, ramping up from 103 million tonnes (mt) in 2000 to 356 mt by the end of 2020 [1] [2]. The GECF Members were following the trend, having exported 130 mt in 2010 to 190 mt by 2019, according to the GECF Annual Statistical Bulletin 2020.

COVID-19 impact on LNG trade was severe, especially in the Q2 and Q3 2020, due to massive lockdowns and multiple various disruptions across the globe. However, by year-end, LNG trade grew to its record number, mostly driven by Asia’s steady demand and underlying global economic recovery. Expanded exports from Australia and the U.S. contributed to the supply side of the equation, with the latter’s 33% growth in LNG exports compared to 2019. In essence, LNG trade has proven resilient, increasingly diverse, and global [1].

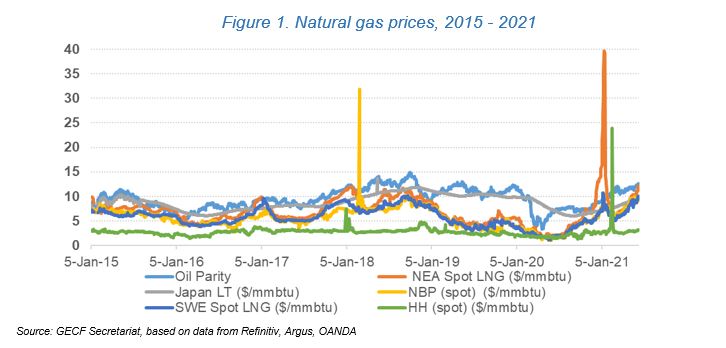

Though the overall LNG market was much more robust compared with the oil market through the course of the pandemic, there were significantly increased volatility in traded volumes and extreme turbulence in spot prices. Late 2020 and early 2021 recorded six-year highs in spot prices in Atlantic and Asia Pacific basins, replacing the record lows of early 2020 in a blink of an eye.

The structure of the LNG trade was evolving over the past few decades and 2020 just amplified that transformation. There is a clear and consistent trend towards gaining higher flexibility, agility, current and forward-looking liquidity of the LNG markets.

Complex LNG investment environment and buyers’ appetite for low-carbon LNG are among the key challenges to be faced by the LNG industry in the foreseeable future. Market extreme volatility is, as a result, translated into uncertainty in the investments.

Natural gas price turbulence of 2020-2021

Though historically, crude oil and natural gas are inherently volatile commodities, 2020 was an extremely volatile year for global crude oil and spot natural gas prices [3]. Although being at initially low levels on average through 2019, the natural gas spot market witnessed plummeting prices, resulting from downfallen demand in the first half of 2020 due to economic, social, and humanitarian impacts of COVID-19 as well as warmer than expected 2019-2020 winter in the northern hemisphere.

Shortly after that world saw a ‘magic’ turnaround. Natural gas spot prices have increased 18-fold from lows seen just six months ago. Natural gas benchmarks demonstrated substantial gains with the start of the heating season in the third quarter of 2020. On top of post-COVID-19 recovery, a general rebound in prices was explained by market fundamentals as well as temporary dynamics, primarily driven by the supply side: colder than expected winter, LNG supply disruptions, and limited shipping capacity.

Natural gas spot price volatility has affected a broad array of industry stakeholders. It impacted the short-term targets of the suppliers and portfolio players to optimise their trading strategies in 2020. LNG suppliers and buyers were reconsidering old and signing new long-term agreements at lower levels of oil indexation, between 10 and 11% record low levels, compared to the earlier 14% slope contracts. The oil and gas majors have been seriously challenged by severe losses in earnings, negative cash flows leading to massive asset write-downs amid high leverage of 30% across the industry. The world’s top energy companies have slashed the value of their oil and gas assets by around US$80 billion by the end of 2020 [4].

Higher flexibility and liquidity of the LNG markets on a roll

The emergence of U.S. natural gas and LNG on the global marketplace, on the supply side, and Japan’s post-Fukushima reliance on LNG on the demand side were leading to the transformation of LNG market mechanics and enhanced commoditisation of LNG. Further liberalisation of the power and gas markets together with market regulations providing for third-party access to the existing gas and LNG infrastructure have been contributing to this trend as well. LNG trade pattern now is backing the growing commoditisation, liquidity, and flexibility trend with (i) higher share of spot and short-term LNG trades in overall trading, (ii) the rise of the LNG portfolio players and increase of flexibility in destination clause contracts, (iii) growth in gas-on-gas indexation pricing, (iv) smaller-scale volumes of the contracts and (v) increased forward-looking liquidity, etc.

LNG was traditionally delivered under long-term arrangements between buyers and sellers, and was only marginally traded on a spot or short-term basis[1]. But since the last few decades, spot and short-term LNG trading has grown steadily, accounting for only 25% in 2012 out of total LNG traded, but since growing to record 40% in 2020 [5] [1]. In a more tight LNG market, especially for the rising Asian LNG demand, the ‘sellers’ market will keep the LNG spot prices relatively high. At the same time, LNG longer-term contracts might accommodate buyers with lower prices and secure sellers by protecting their investment plans in upstream and LNG infrastructure development. Though some LNG legacy buyers in Asia, such as Japan, might focus on increased flexibility and reluctance to commit longer-term due to energy transition uncertainties, there are buyers from China and developing Asia, such as, Pakistan and Bangladesh, who will continue to look at term contracts [6].

From the perspective of LNG suppliers, the GECF Member Countries maintain adherence to the main principles of the 2019 Malabo Declaration, adopted at the 5th GECF Summit of Heads of State and Government. The underlying Declaration fully supports the fundamental role of long-term gas contracts as well as the gas pricing based on oil/oil products indexation, to ensure stable investments in the development of natural gas resources [7]. Such principle provides a solid base for the LNG buyers to gain long-term visibility of their cash flows and on LNG supplies protection against price volatility. Qatar’s long-term contracts represented around 60% of the exports as of 2019 [8]. Algeria, Russia, and other GECF Member Countries have also favoured and will continue to rely on long-term contracts with pricing indexed to oil.

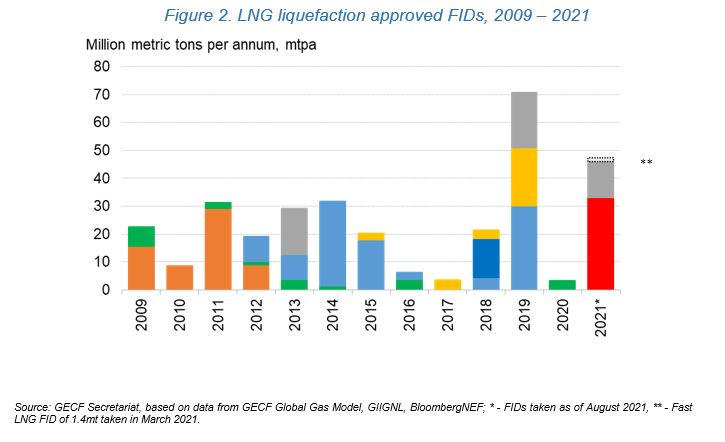

LNG investment resilience in the loop

LNG liquefaction investment decreased by more than a third in 2020 but is anticipated to go up by more than two-thirds in 2021 to over US$23 billion [9]. Qatar, Russia, and the U.S. are leading the trend, whilst Mozambique’s LNG future remains uncertain due to security issues. Qatar’s project, with a final investment decision (FID) of US$29 billion taken in February 2021 on North East Field expansion, which will add 33 mt per annum to the currently existing 77 mtpa, is a game-changer.

Existing and new LNG projects will be facing two major issues: one relating, obviously, to the profitability with project stakeholders realising the agreeable profit margins, and second, being of increased concern, the acceptability issue due to more environmentally stringent ‘greener’ boundary conditions implying on the newly evolving standards for LNG properties.

‘Greener’ LNG to capture the minds of the industry stakeholders

LNG buyers are increasingly considering LNG’s low-carbon properties on top of price competitiveness. The market witnessed a spike in carbon-neutral LNG deals in late 2020 and early 2021 as increasing pressure came from governments’s changing policies and tighter regulations. Furthermore, the corporate sector’s shareholders and investors are increasingly becoming more conscious about LNG’s carbon footprint. Asian buyers’ interest in ‘green’ LNG continued to ramp up last year, crystallising a new sustainable trend of future LNG trading.

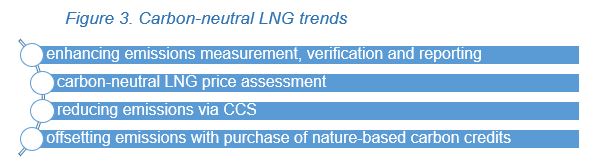

When carbon emissions couldn’t be avoided, they can be either (i) reduced or/and (ii) offset with the purchase of nature-based carbon credits and verified carbon standard certificates. Both carbon emissions reduction strategies should imply more rigorous emissions measuring, verification, and reporting with enhanced and clear guidelines together with emissions transparency along the LNG value chain (Figure 3.). Carbon-neutral LNG price assessment activity (Figure 3) is also underway. S&P Global Platts, in mid-June 2021, announced the launch of the world’s first daily carbon-neutral LNG price assessment (CNL). It tracks the cost of carbon credits purchased and retired to offset the carbon emissions for an LNG cargo on the world’s most active trade route – from Australia to JKTC (Japan, Korea, Taiwan, China) [10]. The LNG industry is anticipated to further address the implementation of improved greenhouse gas (GHG) emissions quantification and reporting methodologies. A carbon-neutral LNG price assessment tool might be applicable to the broader universe of LNG trades. The industry will also continue walking along the ‘lower emissions’ pathway, optimising the reduction of GHG emissions, related to the production and consumption of LNG.

The GECF Member Countries are aligned with the mentioned trend. From the emergence of LNG carbon-neutral deals in mid-2019, JERA delivered the first carbon-neutral LNG into India sourced from a liquefaction facility in Das Island by UAE’s ADNOC LNG, where JERA only partially offset emissions from the regas terminal downstream. In March 2020, Taiwan’s CPC received from Shell its first carbon-neutral LNG at the Yung-An LNG, sourced at Russia’s Sakhalin 2 LNG facility, and in November 2020 its second carbon-neutral LNG – sourced from Nigeria. The mentioned Shell cargoes offset all emissions from extraction to regasification. Russia’s Gazprom also delivered its first carbon-neutral LNG cargo – sourced from the Novatek-led 16.5mn t/yr Yamal LNG project – to Shell at the UK’s 4mn t/yr Dragon in March 2021.

Conclusion

The transformation of the LNG contractual structure vis-à-vis the growing share of spot and short-term trading, multilateral trading schemes, gas-on-gas indexation is leading to increased volatility in the LNG market. Such volatility is an impediment to the development of the gas infrastructure. Also, it creates a need for new patterns for financing the LNG industry as overall investment risks to be distributed in a manner to secure required financing for the upcoming LNG infrastructure projects. Hence, move to a more open and liquid LNG market will lead the key LNG stakeholders and players to search for optimal and lucrative trading strategies. A spot gas-on-gas indexation with destination-free contracts up to the traditionally established long-term oil-indexed destination-bound trades – all that represents a range of possibilities. The latter is historically known for reinforcing market resilience and mitigating risks of increased volume and price volatility and supply disruption risks as well as allowing to secure long-term investment into LNG infrastructure. ‘Green’ LNG with a reduced carbon footprint is rapidly gaining momentum and will be vital for LNG industry development in the decades to come to match the environmental sustainability of the energy transition.