Nigeria Leads Africa’s Upstream Investment With $8 Billion Sanctioned FIDs

…secures five FIDs from eight projects across Sub-Saharan Africa oil and gas industry.

By Ndubuisi Micheal Obineme

Nigeria has retained its position as the top destination for upstream investment across Africa for the second consecutive year, according to Wood Mackenzie’s latest report.

The report highlights Nigeria’s oil and gas investment landscape and its policy reforms and enabling business environment, providing both validation and renewed strategy to strengthen the oil and gas industry in 2026.

Only two Final Investment Decisions (FIDs) were recorded across Sub-Saharan Africa in 2025, with Nigeria securing one of them. The investment includes the Shell–Sunlink HI Field (OML 144), a shallow-water non-associated gas development with 1.9 Tcf of gas and 14 million barrels of condensate, reached FID on the back of Nigeria’s non-associated gas (NAG) incentives issued in 2024, which restored commercial viability and unlocked critical feedstock for NLNG.

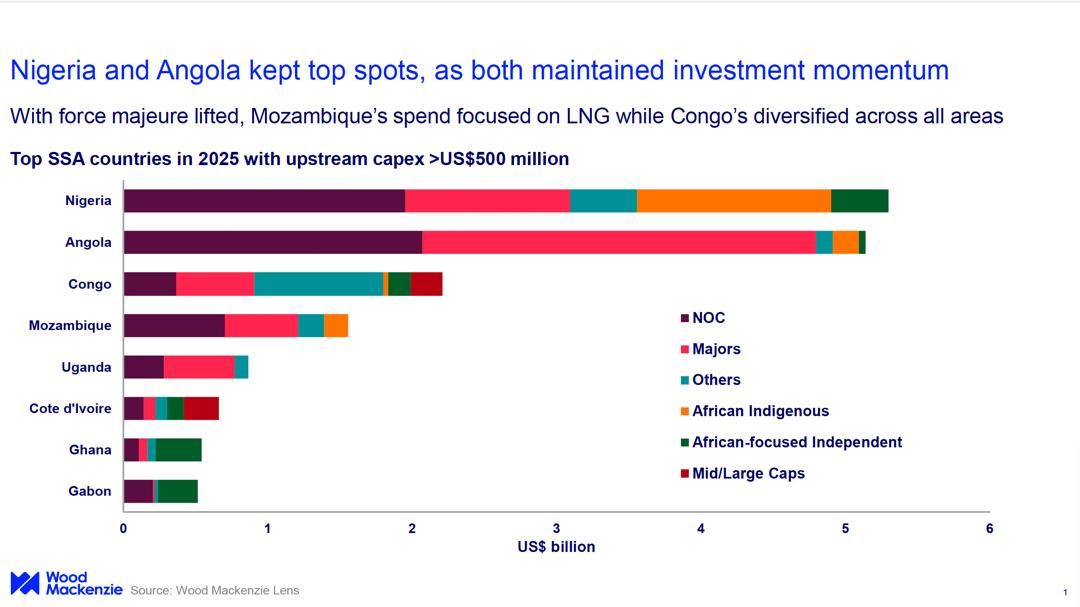

Despite an 18% decline in upstream spending across Sub-Saharan Africa in 2025, Nigeria also retained the top spot for upstream investment in 2025, attracting $5.3 billion in upstream capital investment. This was driven by sustained development drilling across onshore, shallow-water, and deep-water assets, including Bonga and OML 28.

Speaking about this development, Olu A. Verheijen, Special Adviser on Energy to President Tinubu, confirmed that Nigeria secured 4% ($5 billion) of sanctioned African FIDs, covering 6 of 44 projects between 2015 and 2023.

“In contrast, over the last two years, Nigeria has secured 38% ($8 billion) of sanctioned FIDs, 5 of 8 projects across the continent,” Verheijen explained.

She said this turnaround reflects the impact of decisive reforms implemented over the past 24 months.

“Nigeria now offers among the most competitive deep-water fiscal terms globally and the most attractive gas terms in Africa.

“Looking ahead, Nigeria expects additional FIDs, including in Non Associated Gas projects, supported by targeted NAG incentives and a stable, investor-focused policy framework,” she added.